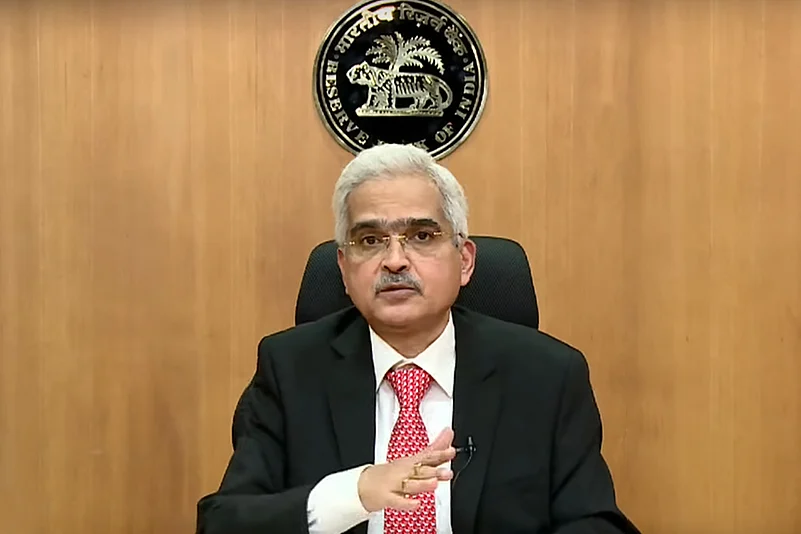

The RBI's rate-setting panel MPC, headed by Shaktikanta Das, began its three-day deliberations on Wednesday. The six-member MPC panel will finalise the bi-monthly monetary policy amid expectations that it may opt for status quo on interest rate on account of inflationary concerns. The resolution will be unveiled on Friday.

Experts are of the view that the RBI may prefer to wait and watch for some more time before taking any major action on the monetary policy front as the central bank's focus is on managing inflation as well as supporting economic growth.

The central bank had left the benchmark interest rate unchanged at 4 per cent at the June policy meeting. It was for the sixth time in a row that the MPC maintained the status quo on interest rates.

M Govinda Rao, the chief economic advisor of Brickwork Ratings, said the MPC has kept key policy rates unchanged since May 2020, after having brought them down to a record low of 4 per cent from 5.15 per cent through two rate cuts (75 bps in March 2020 and 40 bps in May 2020), to assuage the economic consequences of the COVID-19 pandemic.

Moreover, the MPC has continued with the accommodative policy stance after changing it from neutral in June 2019.

"We expect the RBI MPC to hold the repo rate at 4 per cent and continue to be accommodating to support the nascent recovery, in the upcoming MPC. We also expect it to sound a cautionary note and emphasise the need to closely monitor the situation," Rao said.

Vikas Wadhawan, Group CFO, Housing.com, Makaan.com, and PropTiger.com, said, "We expect RBI to continue the status quo in its monetary policy."

He said historically low interest on home loans has played a major role in the gradual revival of housing demand, which was badly impacted during April-June 2020 because of the nationwide lockdown to control COVID-19.

Therefore, it is imperative that low mortgage rates continue for at least the next few quarters to provide the required fuel for the growth of the real estate industry as well as around 200 other sectors linked to it, Wadhawan said.

Jyoti Prakash Gadia, managing director, Resurgent India, opined the MPC is facing the challenging task of delicately balancing the diverse implications of the current economic indices.

Inflation is expected to remain high due to international commodity price trends and persisting supply-side constraints arising out of the second wave of the pandemic.

"The MPC is in its final wisdom, therefore, likely to keep policy rates unchanged. This wait and watch approach, with an accommodative stance, may continue for a while," Gadia said.

The Reserve Bank, which mainly factors in the retail inflation while arriving at its monetary policy, has been mandated by the government to keep the Consumer Price Index (CPI) based inflation at 4 per cent with a margin of 2 per cent on either side.

Inflation ruled above the tolerance band during June-November 2020 and has again moved above the upper tolerance threshold in May and June 2021.

The sense is that inflation will persist at these elevated levels for some months before easing in the third quarter of 2021-22 when the kharif harvest arrives in markets, a recent RBI article had said.