India introduced the concept of reporting overseas assets and financial interest in tax return, way back in 2012. Over the past several years, the reporting requirements in the India tax return have grown in size and scale. The government’s objective to unearth black money is one of the factors that contributed to the increasing disclosure requirements of overseas income, assets and financial interest in the India tax return. The recently notified tax return forms (ITR) for the financial year (FY) 2018-19 are no exception.

Applicability of disclosure

Individuals qualifying as ordinarily residents are required to report their overseas assets in the tax return whereas non-residents and not ordinarily residents, are not required to report these. Individuals who have no income/income less than the basic exemption limit are not required to file the India tax return. It is pertinent to note that this exemption does not apply to ordinarily residents having overseas assets. In other words, tax filing is required for ordinarily residents even if they derive no income from such assets.

Widened scope

Individual taxpayers are required to file ITR 2 or ITR 3 to report their overseas assets and financial interest. Typically, the reporting will be with reference to immovable property, signing authority, financial interest in an entity, interest in a Trust, etc.

The tax returns prescribed for the financial year 2018-2019 have widened the disclosure requirements to include (a) foreign depository accounts (b) custodial accounts (c) equity and debt interest (d) cash value insurance / annuity contracts. Also, the taxpayers will have to furnish peak value of investments/accounts with respect to equity and debt interests held in an overseas entity, depository accounts and custodial accounts.

Reporting period

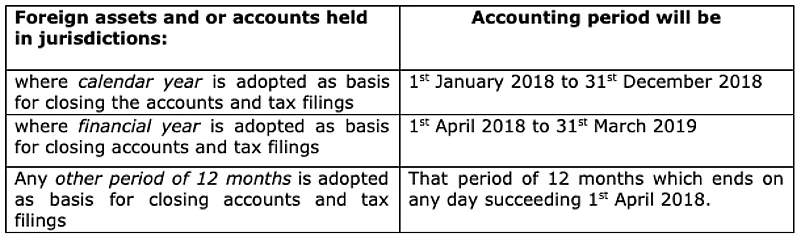

For the first time, the new tax Forms have introduced the concept of accounting period for the purpose of reporting the overseas assets and financial interest. Besides reporting the closing balance and peak balance, even gross income earned from these should also be disclosed with reference to the accounting period. Accounting period has to be determined as under:

The taxpayer will hope that the above reporting, pursuant to period difference, does not create any practical hardships. For instance, while overseas income is taxed with reference to fiscal year April to March, the underlying assets could be reported for the accounting period mentioned above.

Consequences of non-reporting overseas income / assets in the tax return

The government had introduced the “Black Money (Undisclosed Foreign Income and Assets) Imposition of Tax Act, 2015” (BMA). Under this Act, undisclosed income will attract penalty besides tax at flat 30 percent. The penalty could be up to 300 percent of taxes with the risk of prosecution in a few circumstances. Further, failure to report or furnishing inaccurate particulars in return Forms attracts penalty of INR 10 lakhs under BMA. Besides, tax regulations enable authorities to go back in time for 16 years, reopen the case and reassess the income if they believe any income from overseas assets has escaped assessment.

The increased disclosure requirements would warrant taxpayers to be more proactive in collating data, furnishing accurate information in the tax return and maintaining records to successfully pass through the tax scrutiny.

The author is Partner with Deloitte India