India has cemented its position as one of the fastest growing economies globally, especially after Covid-19 pandemic when other countries were facing a slowdown. The Narendra Modi government ended its 10th year with 8.2 per cent economic growth in FY24, while the United States’ GDP grew at 2.9 per cent during the same year.

However, the rating agencies have lowered their growth projections for the Indian economy for this and next two fiscal years. According to the S&P Global Ratings data, India will grow at 6.8 per cent in FY25, a slight decline from the 7 per cent growth forecast. The finance ministry has also stabilised India’s growth number at 6.5-7 per cent in FY25.

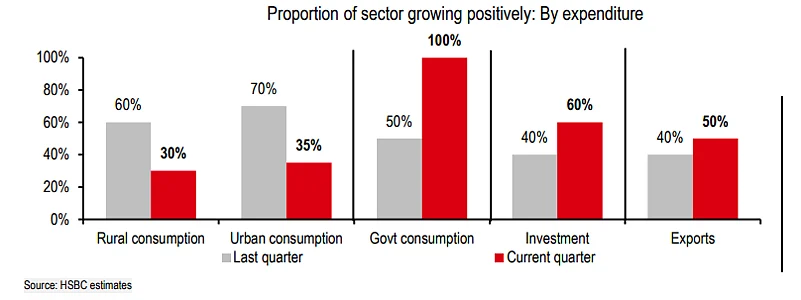

As per the HSBC Global Research data, the economy was falling into a moderate track following a period of rapid stock market gains and robust GDP growth. It highlights the indications of an economic slowdown, with the majority 55 per cent of the Indian economy continues to grow positively, down from 65 per cent a quarter ago.

If we look at sectoral contribution to the GDP, the report suggests that agriculture has shown significant improvement, contributing 15 per cent to the economic growth. And while investment activity is holding up, consumption related ones are slowing. In addition, construction activities also remain strong, supported by ongoing real estate and infrastructure projects, although the pace has slightly slowed.

It added that mining and utilities have experienced a sharp downturn, with none of their indicators showing positive growth this quarter. The communication, trade, and transport sectors also witnessed a downfall, while trade and transport are still struggling to recover, tourism-related activities are flourishing, fueled by pent-up travel demand.

The report notes that while industrial finance remains strong, bolstered by growing credit to small enterprises, consumer finance has weakened due to regulatory measures aimed at reducing over-leverage in the personal loans market.

Moderate Now, Momentum Ahead

Considering the ongoing predictions about the GDP, economists believe that while India is facing some near-time moderation, its long-term prospect remains strong and promising. They attribute this sustainable movement to the country’s thriving startup ecosystem, competitive industrial landscape, and government’s strategic policies to achieve Viksit Bharat vision.

“There is some moderation in store for the domestic economy, however, long term prospects remain robust. The fundamentals remain sound with the right policy mix, availability of a resource base and a strong will to succeed that will enable India’s march to $30 trillion over the next two decades,” Rishi Shah, Partner at Grant Thornton Bharat told Outlook Business.

He said manufacturing and services sector is the key pillar of growth. A recent survey revealed that India’s Services PMI Business Activity Index surged from 58.5 in October to 59.2 in November. But the Manufacturing PMI Output Index slightly fell from 60.4 to 60.2 during the same period.

Another economist emphasised on understanding the interconnected dynamics of ongoing global economic uncertainties and geopolitical tensions for charting out the growth trajectory of Indian economy.

“Experts must assess how the US trade policies are going to shape up, how China reacts to America’s expected tariff imposition, and how the geopolitical crisis will be handled to have a clear direction of the country’s economic growth,” Ajit Banerjee, President and Chief Investment Officer of Shriram Life Insurance suggests.

Banerjee further highlighted the primary reason which propelled comparatively higher GDP growth in previous two fiscal years. According to him, the Centre’s move to increase public capex took the country’s GDP at 8.2 per cent in FY24. Over the past three years, the government capex (capital expenditure) has grown at a CAGR of 30 per cent, rising from an average of 1.5 percent of GDP between FY18-20 to 3.2 per cent in FY24.

“While the government has done the heavy lifting of capex post-pandemic to instill confidence in state governments and corporations for expanding projects and launching new initiatives, the momentum has yet to reach the desired level,” he explained.

An economist at S&P Global Ratings, Vishrut Rana, opined that few factors such as higher labour force participation, technology and infrastructure improvement, stronger household balance sheets, and better industrial policies can support economic growth in India.

For instance, picking a sector for priority development that has high-growth in the current landscape but gets replaced in a few years would not be ideal for sustainable growth, he said.

Another economist said the long-term fundamentals are still intact driven by increasing labor force participation rate, expected rebound in government spending post -election, recovery in consumption patterns from the emerging middle class, and services export growth (up 12.5% year-on-year during April to October 2024).

“We see a lot of available levers both on the fiscal and monetary side to address any continued slowdown trends. Key thing that we are closely watching are inflation and employment trends over the next 6-12 months,” said Rohit Dhawan, Senior Manager, Investment Research & Advisory, Aranca.

Dhawan believes that manufacturing should continue to benefit from the Make in India initiatives and the China+1 diversification strategy, which will drive export growth and industrial output.

The experts said India need to focus on sectors like manufacturing, infrastructure, technology, MSMEs, and renewable energy amongst others. With the right policies in place and an evolving industrial landscape, the country is poised to achieve its vision of becoming a $30 trillion economy in the coming decades.