Karthik, Anuradha and their 2-year-old son, Advik Nagaraja Rao, live in JP Nagar, Bengaluru, which still has its share of green surroundings. The household is complete with their pet dog, Pepper. Karthik works for a professional services company providing consulting services to an aerospace and defence contractor based out of Canada, while Anuradha works as a senior process manager at a bank. Both at 31 earn well and lead a comfortable life, with clear financial targets on their mind, which are also mapped well with the appropriate timelines.

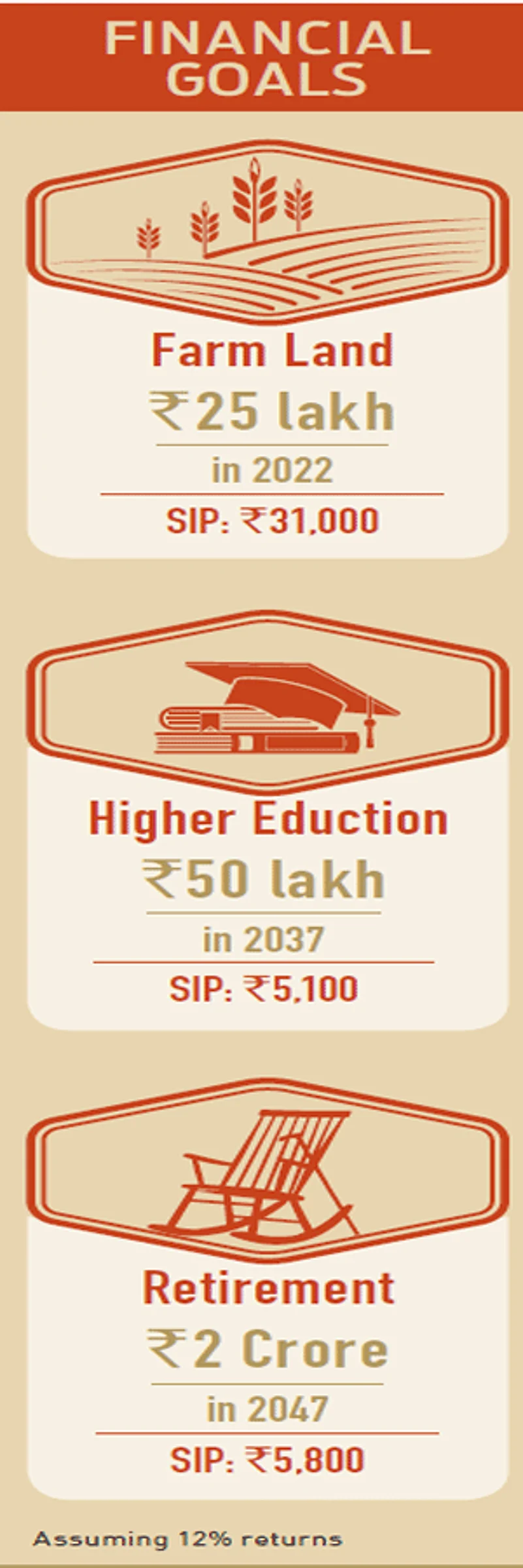

I always feel happy if someone has already set goals with this much clarity. They have a goal to have Rs 25 lakh for purchase of land five years from today. They will need another Rs 50 lakh for higher education of their son 20 years from today and lastly, they have targeted a corpus of Rs 2 crore for their retirement. My suggestion to them is to start with a contingency fund, which will help them meet any contingency they may encounter in the future. This corpus can be created with the help of their existing investment worth Rs 10 lakh in their fixed deposit and shares.

Fulfilling goals

Purchase of farm land-first and short term financial goal is to purchase a farm land in the next five years. For this, they need to have a systematic investment plan of Rs 31,000 in a balanced type fund. The next big goal for them is in the form of son's higher education, which should be in about 20 years hence. For this, they should set aside Rs 5,100 in an SIP, which should be in a well diversified equity fund. As for their retirement goal, which they are thinking of 30 years hence, they will need to start an SIP in a diversified equity fund with Rs 5,800.

My advice

One important role of financial planning other than meeting your set goals is wealth creation. This couple has the set mindset of saving at least Rs 50,000 per month. Their existing set goals can be met with an SIP of Rs 41,900. Now the remaining Rs 8,100, if invested diligently in proper equity fund, will give the couple wealth of Rs 2.8 crore created at the end of 30 years. Gradually if the SIP amount is increased properly, then the amount of wealth that they will be able to create will be exceptional. As such, the couple has exhausted their savings and investments under Section 80C limit of Rs 1.5 lakh.

Looking at the concept of human life value, both Karthik and Anuradha individually should have a life cover of Rs 1 crore each. This requirement can be fulfilled with the help of term insurance plans. They should reassess this requirement once every few years depending on changes in their financial goals as well as changing circumstances in life. For now, they have sufficient amount of health insurance and there is no need to further increase it.

They can improve their finances by being careful when taking any other financial product. For instance, they have traditional Moneyback policies in their portfolio, which are not financially the best, but one tends to have an emotional attachment to these. By redeploying the payout that they get from these policies in mutual funds properly, which has been suggested to them, they will be able to achieve all their listed financial goals. So, this planning should be fruitful for the couple helping them meet their set targets and also create wealth at the same time. Happy investing! Make your dreams.