A rainy morning on a busy working day sparks a discussion on climate change at the AM Naik Tower in Mumbai. Subramanian Sarma, the whole-time director at Larsen & Toubro (L&T) and president of its energy vertical, talks about the spate of flooding in the country. “I had to send a note to our staff in Vadodara this morning due to a huge downpour there which has caused flooding,” he says, sitting in his office, which overlooks the Powai Lake.

For the infrastructure giant, the theme of climate change has presented an opportunity as well as a huge challenge. The move towards cleaner energy across the globe has presented interesting opportunities for the company. Although the company is still a major player in the construction of thermal power plants and continues to pick up projects for boilers, turbines and generators, Sarma notes that recent investments will help the company reap the benefits of the green energy transition.

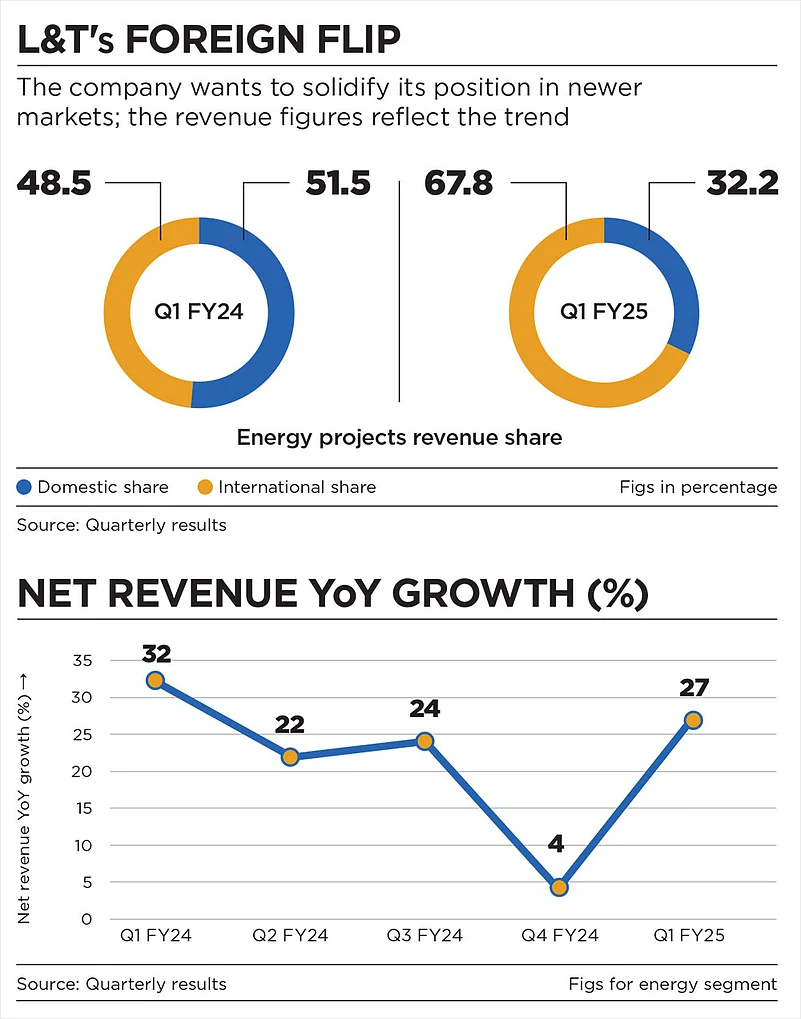

L&T’s bullishness stems from the fact that it is now able to balance cycles in projects of the segment by venturing out and winning more bids in the international markets, particularly in West Asia. The first quarter results for the current financial year reflected the trend. In the first quarter of the last financial year, the domestic market’s net revenue share in the energy segment was over 51%. The trend flipped dramatically in the current financial year when the company reported that nearly 68% of the net revenue came from international markets in the same period.

It is this momentum that L&T wants to capitalise on. And the company has figured out ways to solidify its position in newer markets.

Winning Around the World

The energy segment of the firm has undergone several key changes over the past couple of years. A big one involved the consolidation of its hydrocarbons, power projects’ engineering, procurement and construction (EPC), and green energy EPC under one umbrella—the energy segment. Moreover, the company announced in July that its power EPC business under the energy segment was turned into carbon-lite solutions, which will try to leverage decarbonisation opportunities.

The size of the pie L&T is looking at just in West Asia is big. The firm predicts opportunities worth $60bn (over Rs 5 lakh crore) in the energy segment by 2027

Within the infrastructure segment, the company has carved out renewable energy EPC projects from the existing power transmission and distribution business. In its statement after the move, the company emphasised its presence in West Asia and other regions such as Saarc, Asean and Africa.

L&T’s pivot, according to Amit Anwani of stock broking firm Prabhudas Lilladher, is due to its bid to win over international markets. “When the domestic market dries up, the international markets can have a huge advantage for them. The company is getting massive orders from West Asia,” he says.

Last October the company announced it had won an ultra-mega hydrocarbons project from a West Asian client. Ultra-mega projects are those worth more than Rs 15,000 crore. It won a major project (valued between Rs 5,000 crore and Rs 10,000 crore) in the same segment in March this year.

The renewables segment, housed previously under the infrastructure division, is also bagging significant orders in the same region. The company won contracts to construct two large-scale solar photovoltaic plants with a combined capacity of 3.5 gigawatts (GW).

Sarma explains that there are two tangents on which the international markets are working right now. “Firms are not sure if they will be able to monetise their hydrocarbon assets in future. So, they are going big now. Another is the obvious push for adopting new energy sources to ensure future survival,” he says.

The size of the pie the company is looking at just in West Asia is big. The firm predicts opportunities worth $60bn (over Rs 5 lakh crore) in the energy segment by 2027. But there are some obvious risks. The region is known to be geopolitically volatile with the Israel-Palestine conflict already disrupting global supply chains. Iran, Lebanon and Yemen have already been drawn into the conflict and concerns remain that the tensions might spread even wider.

However, Sarma insists that the company is not unduly worried. L&T is hedging by diversifying its projects across the region and not depending on one big player. The company has bid for projects in Abu Dhabi, Kuwait, Qatar and Saudi Arabia, among others.

The company is receiving orders in the old conventional hydrocarbon space to fulfil the demand in these markets. It is also ramping up its execution in the oil-to-chemicals business. But from a long-term perspective, the energy head explains that the company is positioning itself to succeed in the green vertical which will require innovation and investment.

Investing to Diversify

L&T announced a $2.5bn investment in green technologies in 2022 over a three-to-four-year period. Since then, the company has been investing heavily in the development of solutions for green hydrogen, offshore wind and electrolysers.

The bid to innovate is crucial as it looks beyond West Asia. Of the overall order book, 35% of orders were from West Asia while just 0.4% came from Europe and the US. The company wants to leverage the cost arbitrage available to it in electrolyser manufacturing. It signed an agreement with French player McPhy in March 2023 for the manufacturing process.

L&T commissioned India’s first indigenously built green hydrogen electrolyser in March which was manufactured at the AM Naik Heavy Engineering Complex in Hazira (Gujarat). Sarma says the company can build on this success and look at exports as keeping 90% of components indigenised can provide the company a cost advantage.

The diversification into different markets is going to intensify in the coming years with investments in modular services. The company has started providing energy solutions in Europe, the US and Australia. However, the company will not establish in-country services in these countries. Instead, it wants to use its base in India to build modular plants here and then export them to the international markets.

With the energy order book at over $14bn—its highest ever—the company has tailwind over the next three and a half years

According to the company, it has worked with clients in the Netherlands and Australia recently for modular plants. Moreover, it is also looking to tap wind energy opportunities which will be an extension of its existing offshore business.

“We have already been approved by many European and US customers and we are going to supply to them,” Sarma says.

The company has also formed a green council to aid its research into new technologies. Experts say that technological innovation is key for the company as it has shifted its focus to an asset-light balance sheet.

Abhishek Jain, head of research at Arihant Capital Markets, says that the company will have to ramp up investment even further. “Technological advancement remains a significant hurdle, as the company must continue to invest in cutting-edge technologies to stay competitive, particularly in the green energy segment,” he says.

"Firms are not sure if they will be able to monetise their hydrocarbon assets in future. So, they are going big now. Another is the push for adopting new energy" Subramanian Sarma, President (energy), L&T

Value Creation for the Future

In the overall order book of the company, the energy segment constituted a 25% share at the end of the financial year 2024. The energy segment’s net revenue grew by 19% in the last financial year, with L&T’s overall revenue growing at 21%.

With significant momentum and opportunities available in the energy segment, which constitutes hydrocarbons, green hydrogen and carbon-lite solutions, the target for growth remains 12–15% CAGR.

The decision to consolidate the energy offerings under one umbrella and the high demand for investment in newer technologies has also presented the question: can the vertical look to list in future?

Sarma says the company thinks from a very different perspective. “There are many companies out there who are playing just the valuation game. We want to deliver long-term returns for our shareholders. There is no constraint on financial resources, and we have enough capital to invest,” he says.

The net cash flow from operating activities for L&T was Rs 18,266.28 crore at the end of the financial year 2024. The share price of the conglomerate has surged by over 26% in the last year. Analysts remain confident that the company is in the right position to invest and capitalise on the opportunities available in the market.

Prabhudas Lilladher’s Anwani says that the working capital situation for the company is healthy while the order inflow is intact. “They can create a lot of value depending upon the order inflow. The company has hedged against the risks by diversifying its offerings,” he says.

With the energy order book at over $14bn—its highest ever—Larsen & Toubro has tailwind over the next three and a half years. But order execution and a stable environment in the markets it is operating in are crucial for it to be able to maintain momentum. Dabbling with new tech like green hydrogen in the segment means a lot remains untested. All eyes will be on cost stabilisation.