While the first ESG fund came into play in the market long back, most of the sustainable funds saw their inception when the pandemic came bringing with itself a big sphere of economic uncertainty. Fast forward to now, ESG funds are struggling to gain the interest of investors which is evident from the limited number of ESG schemes available in the market coupled with net outflows in assets under management (AUM) on a year-on-year basis.

What started as euphoria soon fizzled out as fund houses noted sluggish investor interest. Analysts tracking the sector often cite the nascent factor of sustainable funds for these figures. As the noise around ESG continues to be high, many analysts seem to be passively bullish on this fund category.

However, it is worth questioning: given the current numbers, how the optimism around sustainable funds justifies the underperforming figures of today and whether such funds will find their moment under the sun?

Sluggish Interest In ESG Funds

Over the past year, ESG mutual funds experienced an efflux worth Rs 1,684.84 crore, with a significant net outflow of Rs 891.53 crore in 2023 alone, as per a report by Morningstar. This came at a time when interest in equity mutual funds surged to record highs, with inflows coming in at Rs 19,932 crore in October.

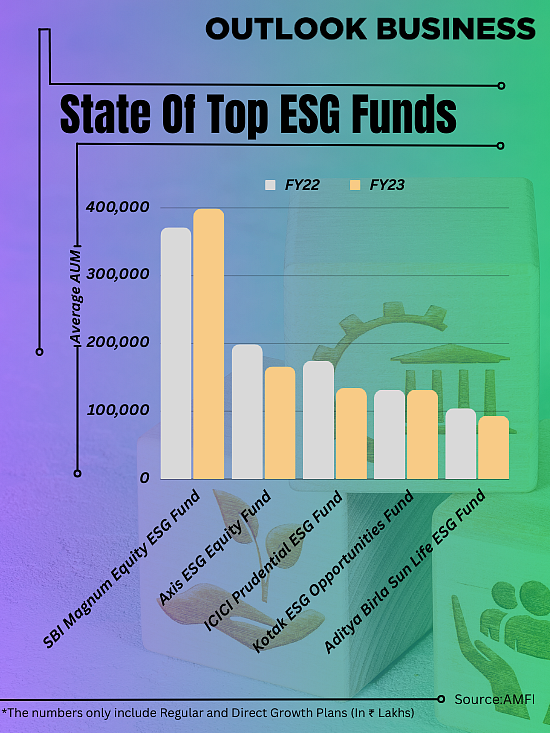

Within the context of financial metrics, there is no denying the fact that if we compare the past year returns of benchmark indices, or even mid-cap, small-cap or large-cap funds, the figure of returns stands nowhere near that of ESG funds. Where sectoral indices managed to pave the way for double-digit returns consecutively, sustainable funds struggled to deliver minor returns.

Data as of October 22 showed that the weighted average 2-year return of the top five small-cap funds by AUM has been 18.66 percent. For large-cap and mid-cap, the figure has been 5.85 per cent and 13.10 per cent respectively. Now, if we compare these returns with the weighted average 2-year return of the top five sustainable funds by AUM, the figure is a mere 3.30 per cent.

The low competitiveness in a way explains the sluggishness of investment in the funds and the lack of interest shown by fund houses in launching these funds.

“The concept of sustainable investing and ESG funds is still very new to Indian investors. Most investors who have invested in these products have done so because of the push from their advisors, more than their interest in sustainability,” says Shruti Jain, CSO at Arihant Capital Markets Ltd.

While the advent of ESG funds attracted strong investor confidence during the pandemic, reaching the same level of euphoria, especially among retail investors, seems quite challenging at the moment given the current figures.

Compared to other mutual fund products and equity-based schemes in the market, the ESG segment has a relatively limited number of schemes. According to a report by Morningstar, the majority of ESG schemes were launched in the year 2020. This trend highlights a lack of confidence, not only on the part of investors but also among fund management institutions.

Problem of Confidence

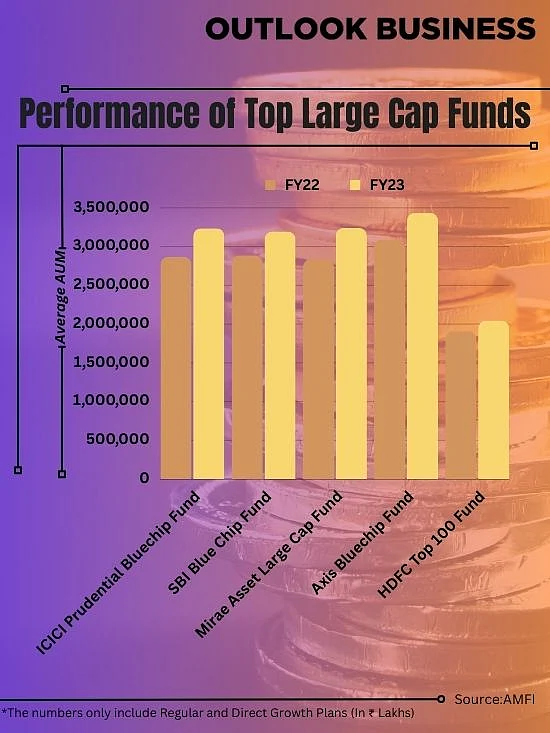

Mukesh Kochar, National Head of Wealth at AUM Capital, says that foreign institutional investors (FIIs) prefer companies that fit in the ESG framework. “These funds are large cap oriented with very small exposure in the mid or small cap as companies with ESG framework are limited. ESG funds is a kind of alternative to large-cap funds with a filtration of ESG framework.”

Traditional large-cap funds continue to outperform the ESG funds due to the difference in the exposure. The distinction in the level of returns between Nifty 100 (representative of Large cap funds) and Nifty 100 ESG is particularly pronounced in their sectorwise exposures. Large Cap funds, as indicated by Nifty 100, tend to have a greater exposure to the BFSI sector. In contrast, Nifty 100 ESG, demonstrates a higher allocation to sectors such as Information Technology (IT) and Healthcare. This sector-specific contrast can largely be the reason for the difference in the level of returns posted by these funds.

Analysts point to the fact that compliances and methodology become the weak link for ESG funds which reduces the confidence of institutional investors. Pratik Oswal, Head of Passive Funds at Motilal Oswal Asset Management Company, says that the subdued interest in ESG investments can largely be attributed to the inconsistency in compliances that support such fund schemes. This lack of clarity in the methodologies has further compounded the decline in interest in ESG schemes.

In Deloitte's 'ESG preparedness survey report', almost 60 per cent organisations placed high-level importance on establishing ambitious ESG goals for the future. However, the ambitious picture takes a plain turn as only 27 per cent of businesses are well-prepared to meet ESG requirements.

There is a conspicuous gap between the corporate eagerness and present preparedness to meet ESG requirements. If the corporate side is facing an 'all talk and no action' road, no doubt investors' skepticism will incline them to not put their money in such equity schemes.

A Hope For The Future

Distinguishing between short-term fluctuations and the long-term viability of investment themes has always demanded investor time before they actually put their money to play. Market dynamics and investor behavior are influenced by a quest for immediate returns and can often overshadow the underlying fundamentals of an investment. Many investors believe that the recent outflows from ESG funds may simply reflect a temporary dip in performance rather than a fundamental rejection of the ESG principles.

“ESG is something that is going to become critical and integral actually to managing money. It is not really possible to make long term investment decisions disregarding the effect of sustainability and the business models. But yes, the short-term ups and downs and cycles will be part and parcel of the game. Even long-established thematic products have faced periods of outflows when short-term performance falters,” says Ashwin Patni, Head of Products & Alternatives at Axis AMC.

As per a recent report by Avendus, the AUM of ESG funds in India is projected to increase by approximately 30 per cent annually for the next 5-10 years, potentially reaching 34 per cent of total AUM by 2051. This might show that ESG investments, are perhaps a slow-cook recipe, gradually gaining momentum.

With negligible growth in the current AUM set of ESG, analysts are betting high on the potential of sustainable funds. Market regulators and financial custodians are trying hard to push compliances that support ESG practices in corporate as the sustainability aspect starts dominating the revenue sheet of international trade. The inception of BRSR (Business Responsibility and Sustainability Report) is one such initiative taken by SEBI.

“With the awareness of ESG funds growing, and more people realizing the importance of considering ESG factors in their investing strategy, the demand for such products will only rise,” says Jain.

While the future might seem too blurry considering the recent returns, it is worth noting that the government’s continuous push towards sustainability and green methods will urge corporates to employ ESG-driven compliance. This will eventually lead to a greater focus on sustainability scores and ratings which will reflect in the creation of a better protective layer against the losses resulting from forthcoming climate change. As the corporate will strengthen their ground fundamentals, it could result in better performance on the markets which may finally attract investors' attention.