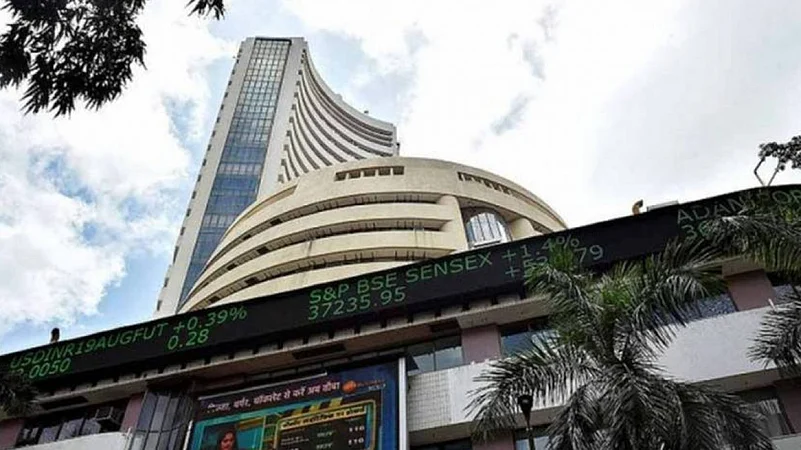

Shares of India’s oldest stock exchange BSE Limited rallied on Thursday following the introduction of a new regulatory framework by the Securities and Exchange Board of India (SEBI) to oversee the F&O market, which was perceived to be less stringent than expected.

On Tuesday, SEBI released a set of six guidelines that included restricting the weekly expiration of index futures and collecting premiums upfront. These rules will come into effect in a graded manner between November 2024 and April 2025.

On Thursday, BSE shares opened at Rs 3,800 on the NSE and touched a 52-week high of Rs 4,235. The stock has given stellar returns to investors as it surged over 200 per cent in the last year and 2,000 per cent in the last five years. At the time of writing, the stock was trading 2 per cent up at Rs 3,942 per share on the NSE.

The capital markets regulator had proposed tightening the framework for equity derivatives trading earlier in July, raising concerns across the market. However, the actual changes including a hike in entry barriers and higher trading costs turned out to be milder than anticipated.

Following SEBI’s new framework, BSE is likely to gain an edge against rival NSE in the derivatives market. The regulator proposed to limit weekly derivatives contracts to one benchmark index for each exchange – BSE and NSE. Currently, NSE has an expiry on all days except Friday, making it difficult for India’s oldest exchange to increase volumes. Under the new rules, BSE will have three extra days to compete against NSE.

Brokerage firm Motilal Oswal Financial Services (MOFL) says BSE should be relatively less impacted in the new regulatory environment compared to NSE. In addition, the exchange has other revenue drivers such as the colocation segment and new products like commodities and power.

SEBI will implement the new framework to regulate the high-risk world of Futures and Options by taking six measures including increasing the contract size to Rs 15 lakh from Rs 5-10 lakh and limiting weekly expiries to one per exchange. The new rules are based on recommendations by an Expert Working Group (EWG) to strengthen the equity index derivatives framework.

MOFL has maintained a ‘Neutral’ rating on BSE. In its report, the brokerage said if the derivatives volumes declined by 20 per cent instead of the 22 per cent growth that was projected, the impact on BSE earnings would be minimal and the premium to notional turnover ratio would rise from 0.072 per cent to 0.09 per cent.

According to global brokerage firm Jefferies, as system premiums decline, retail-focused discount brokers and exchanges (BSE) will be most impacted. Jefferies has reduced its EPS for BSE by around 10 per cent, assuming the discontinuation of the Bankex product. The focus will continue to be on the volume impact on the ongoing product (Sensex).