American humourist Will Rogers once famously said, “The difference between death and taxes is death doesn’t get worse every time Congress meets.” That one-liner aptly reflects the sentiment of Indian cigarette manufacturers. Every time the finance ministry gets ready to announce the Union Budget, investors in these cigarette-makers girdle up for tax hikes that hurt their stocks. ITC has been a victim of this routine, with its stock giving a return of -4% CAGR over the past five years.

The last Union Budget was no different. Finance minister Nirmala Sitharaman raised the “sin” tax and announced an increase in the National Calamity Contingent Duty (NCCD) component between 212% and 388% for cigarette sticks of various sizes. It came as a huge blow to the company since the cigarette business makes up for 41% and 83% of the overall revenue and Ebit, respectively. Meanwhile, FMCG, hotel, agriculture and paper businesses account for 59% and 17% of the topline and Ebit, respectively. The stock tanked 12% on Budget day.

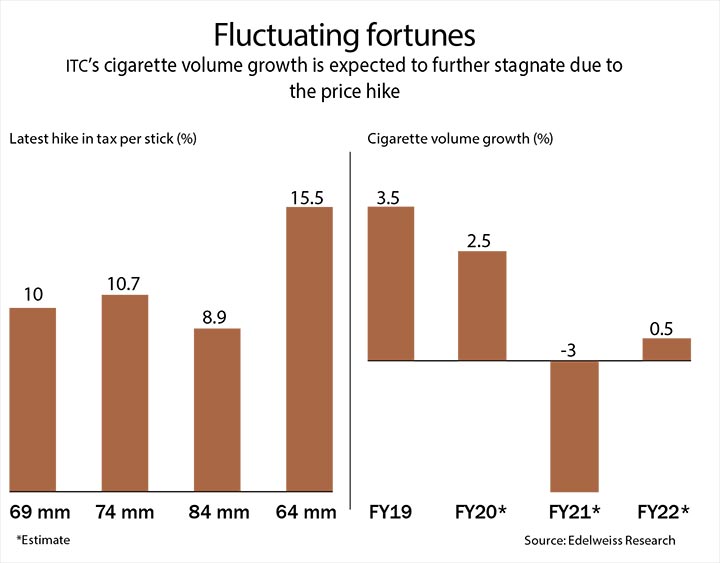

“The government didn’t have any other avenue to increase taxes, and GDP growth is extremely low. This is one tax that is easy to implement since it comes under the ‘sin’ category, and there won’t be any hue and cry,” says Abneesh Roy, senior vice president-research, Edelweiss Securities. For ITC, the Budget announcement would translate into a tax hike of around 9-15%, and the company will have to increase prices by 6-7%. “Whenever there is a tax hike, the company is forced to hike prices, and affordability becomes a concern for customers. Cigarette companies everywhere face this problem,” says Roy.

This also results in migration of buyers towards illegal cigarette makers. According to The Tobacco Institute of India, illegal cigarette trade — smuggled internationally and locally manufactured — accounts for as much as one-fourth of the industry in India. This method of tax evasion rises when the government increases tax and imposes extreme regulations on the cigarette industry, notes the institute. Roy expects cigarette volume growth of organised players to decline by 3% in FY21, as illegal players gain market share. “The market share of illegal firms is around 20-22%, and they will be able to gain 100-200 basis points market share in a year,” he estimates, though he believes this trend will not sustain.

Shyam Sekhar, founder of investment advisory ithought, also holds the same belief. “Many are assuming that the government will behave irrationally. If the market continues to shift towards unorganised space, it will also impact the tax collection. So, the government will continue cracking down on illicit trade and responsibly levy tax hikes,” he says. Therefore, though the stock is far off its 52-week high of Rs.310, ITC will not be cheaply valued forever.

Roy says the market will absorb the tax hike. “Customers are habituated to the hikes. For the first few months, volume drops, but then recovers again,” he says. For instance, after a sharp hike in taxation in FY18 — 6% in Budget and 11% in GST — the volume dropped for three quarters, but recovered in FY19 (See: Fluctuating fortunes).

JOKER IN THE PACK

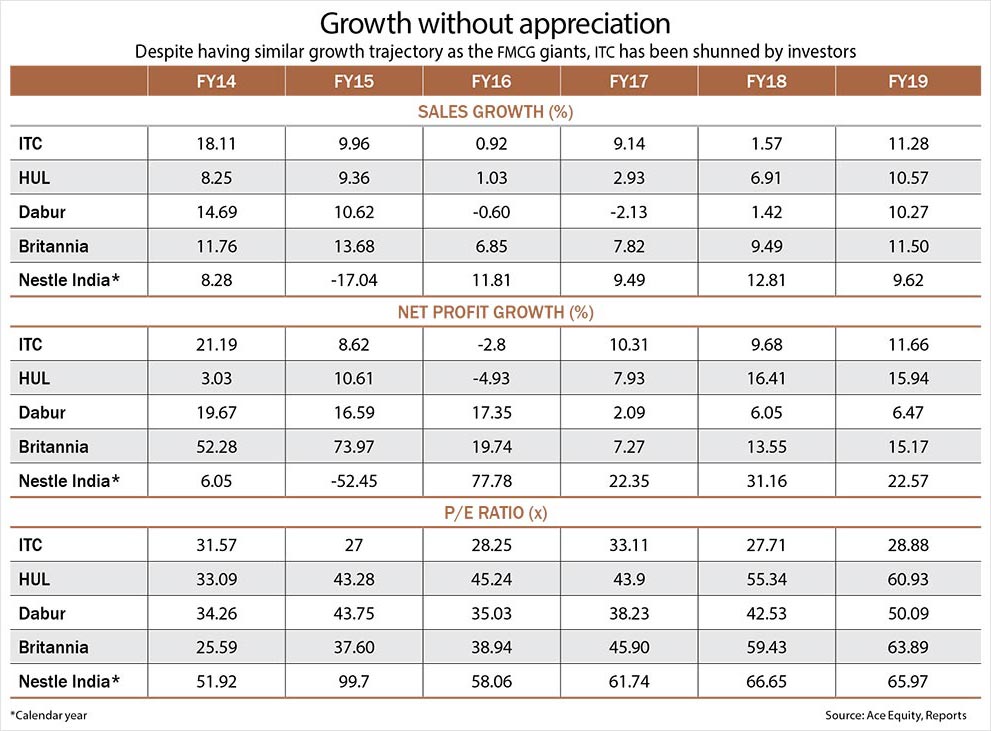

Despite the setbacks, ITC’s net sales has grown at 11% CAGR between FY10 and FY19. In comparison, Nestlé, HUL, Dabur and Britannia have registered average annual net sales growth of 7.8%, 9%, 10.8% and 12.9% respectively. They have also reported similar earnings growth trajectory, except Britannia, that has outperformed. In fact, ITC’s net profit has been growing at 13.7% CAGR over the same period, whereas CAGR of Nestlé India, HUL, Dabur and Britannia’s profit have been 10.25%, 12.12%, 12.46 and 31% respectively. Even after proving its worth, ITC has underperformed when compared to other listed FMCG players, and the gap has only widened with the recent drop in cigarette volume (See: Growth without appreciation).

“ITC’s financial performance in the past 10 years has been a story of two halves. Spectacular performance in the first half of the decade witnessed 16-22% CAGR growth in sales, Ebitda and PBT. But in the subsequent five years, sales, Ebitda and PBT growth have declined to 5.6%, 6.7% and 7.3% CAGR respectively,” says Krishnan Sambamoorthy, VP-research, Motilal Oswal Financial Services. This downturn in its earnings growth has come alongside tax hikes in FY16, FY17, FY18 and FY20, through excise duty, GST and NCCD. Added to this mix has been the consumption slowdown, which has drawn blood from companies across sectors. In Q3FY20, even before the tax hike came into play, the company reported cigarette volume growth of 2.5% year-on-year, down from 7% the previous year, which was on a lower base in FY18.

But as the company tries to keep its head above the wave of bad news, a few experts believe this is the perfect entry point for value investors. After all, ITC boasts of strong cash flow, return on capital employed (RoCE) and brand recall. Also, it is not just a cigarette manufacturer. While that continues to be its mainstay with some of the most popular brands such as Gold Flake and Classic, ITC has carved out a space for itself in the FMCG space, which has become the second-largest contributor to its revenue. Brands like Aashirvaad, Sunfeast and Bingo are leaders in their categories, and the segment has grown at a steady pace over the past few years. Revenue has risen from Rs.90 billion in FY15 to Rs.125 billion in FY19. In the same period, Ebit margin has risen from 0.4% to 2.5%.

And, despite the current COVID-19 hiccup, it is only expected to get stronger in the coming years. “With ITC’s strong and wide distribution network of six million outlets, we believe the FMCG segment would stand to gain as it enters into newer categories with different product offerings,” says Sanjay Manyal, analyst, ICICI Securities. These product offerings are as varied as ITC’s diversified businesses — from Chatpata Swing snacks and YiPPee Quik Mealz Khow Suey instant noodles to biscuits, cakes, and even deodorants and skin care products.

Manyal believes the company’s FMCG business should be valued 7-8x price-to-sales, similar to ITC’s FMCG peers, since the company’s growth in the segment has been driven by expanding scale and better profitability. “Its Ebit margin can easily reach double digits in the next six to eight quarters. Meanwhile, revenue from this segment can rise to Rs.140 billion,” he says, even taking into account the prevailing slowdown in the economy.

The next chunk of its revenue comes from paper, hotel and agri businesses, which together contribute 33% and 14% of revenue and EBIT, respectively. Even though the paper business has been growing at a weaker pace — just 0.8% in Q3FY20 — from a falling demand, the hotel business grew 22% year-on-year in the same quarter with improved food and beverages sale, room rates and revenue per available room. However, it is the hotel business which might end up taking it on the chin over the next two quarters, due to the lockdown.

VALUE HUNT

Largely, ITC’s move to decrease dependency on the cigarette business has fared well for the company. For the first time in FY19, the revenue share of cigarettes dropped below 50% and in Q3FY20, the cigarette business contributed 41% to the topline. While the steady earnings growth is testament to ITC’s fundamentals, the company is also sitting on cash of Rs.41 billion, which could fund further capex or increased dividend payout.

Analysts believe at its current price of Rs.180, ITC is available at an inexpensive valuation of 14x its estimated FY22 earnings. That’s a sharp discount compared to other FMCG players such as HUL, Dabur, Nestlé and Britannia, which are trading at 52.3x, 42.8x, 59.5x and 38x, respectively. Manyal is not betting on the stock trading at 50x multiple, but says there is decent return to be made. According to him, it should be valued at least 20-25x forward multiple. Also, he adds, the cigarette business should command more than 10x price-to-earnings multiple since it continues to be a cash generating business.

Sekhar points out that ITC appears reasonably priced even when compared with global players such as British American Tobacco and Philip Morris, which are trading at 9.1x and 14.8x on forward basis, respectively. “The earnings multiples of Philip Morris in the US, which is not even a growth market, are extremely high. In comparison, ITC is cheaply valued in India despite having the bandwidth to grow,” he says.

ITC is not getting the valuation it deserves, says Manyal, because of high float and institutional holding. “The float is around 100%. There has always been a risk that government-led insurance entities, which hold a significant stake in ITC, could offload it,” he states. These insurance companies currently hold 20.61% stake, with LIC alone accounting for 16.25%. Then there is the remaining 8% holding of UTI, which acts an additional headwind. Sekhar says the poor valuation is also because of the group’s history with misallocation of capital, which happened in the ’90s. “Then, ITC was heavily into financial services and had a mutual fund business, too. This kind of diversification didn’t work,” he explains, adding that the company should announce a buyback or dividends, which can help in its re-rating.

ITC remains the undisputed leader in the cigarette business in the country, despite the draining taxes. Therefore, sales will continue to grow, even though it is a slow chug now. If investors want to smoke their ‘sin’ away, this seems like a good time.