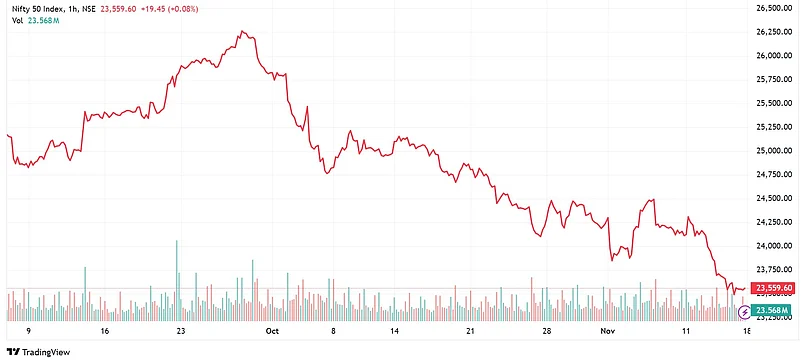

Amid unrelenting FII selling, the NSE Nifty 50 index settled in red for the sixth straight day following a sea-saw trade on Thursday. The benchmark dropped by 26.35 points or 0.11 per cent to close at 23,532.70. The BSE Sensex dropped 110.64 points or 0.14 per cent to settle at 77,580.31.

The Nifty 50 ended lower for the second consecutive week, dropping 2.55 per cent. Earnings from India Inc. and a rising preference for safe-haven assets like the dollar index and U.S. treasury yields weighed on investor sentiment, dampening demand for risk assets like emerging market equities.

Other factors including persistent FII selling, a slowdown in economic growth, a weakening rupee, sticky inflation and high interest rates. All this combined, have eroded investor sentiment, leading to sustained market corrections.

Factors Driving the Current Market Weakness

The Indian rupee hit lifetime low of 84.40 against the US dollar on Thursday, continuing its decline amid a strong post-election rally in the dollar and rising US interest rates. The dollar index has surged to a year-high of 106.64, up nearly 3 per cent since Trump’s election, driven by expectations of import tariffs and corporate tax cuts. The US 10-year Treasury yield reached a 3.5-month high of 4.48 per cent.

The aggregate revenue of 372 companies from the Nifty 500 index recorded single-digit growth of 8.2 per cent, while profit after tax remained flat, according to Outlook Business analysis.

On a sequential basis, the aggregate revenue grew 0.64 per cent and PAT fell 6 per cent. The Q2 earnings season witnessed highest number of earnings downgrades following the Covid-19 pandemic.

In the last one and a half month, FIIs have remained net sellers in Indian equities redirecting funds to other markets including China and Hong Kong. FIIs have offloaded nearly $13.7 billion in Indian equities in October and November till date, as per data from NSDL.

Vinod Nair, Head of Research, Geojit Financial Services says the domestic market experienced a lackluster trading on Thursday, but some stability was observed throughout from the low of the day.

“The sustainability of this trend remains uncertain as FIIs continue to be on the selling side. But on a positive note the degree of selling is reducing. Asian markets too displayed mixed sentiments as investors evaluate potential risk due to a likely change in the US policy with trade barriers,” he said.

The economic momentum has shown signs of moderation in recent months, primarily due to subdued government capital expenditure (capex) which currently stands below 40 per cent of the budget estimate – a notably low level not seen in over a decade.

In October, Wholesale Price Index (WPI) rose 2.36 per cent due to increase in food and fuel prices. On a sequential basis, WPI inflation, increased 0.97 per cent, with food index again contributing the most with a rise of 3.02 per cent. Wholesale food prices increased 11.59 per cent during October, compared to 9.47 per cent in September.

Retail inflation breached the RBI's upper tolerance level, soaring to a 14-month high of 6.21 per cent in October mainly on account of rising food prices, dashing hopes for rate cuts in near-term.

India’s trade deficit, the gap between imports and exports, stood at $27.14 billion in October from $20.78 billion in the preceding month. This figure was higher than the range of estimates from 22 economists tracked by Bloomberg, which varied from a deficit of $25.5 billion to $20 billion.

Saurabh Patwa, head of research and portfolio manager at Quest Investment Advisors says while this slower pace of spending is partly due to the focus on upcoming union and state elections, the delay has a tangible impact on both sectoral capex and the broader economy, with signs of slower growth, particularly in urban areas.

Possible Rebound Amidst Challenges

However, experts suggest that a potential rebound could happen on the back of anticipated increase in government spending and seasonal economic uplift.

According to Patwa, while forecasting exact market movements in short to medium term is challenging, certain factors suggest potential for a rebound. An uptick in government spending in the second half of the fiscal year, combined with the seasonal economic uplift, could serve as a catalyst for recovery.

“Valuations have become somewhat more attractive after recent corrections, even accounting for recent weaker-than-expected earnings, which may create opportunities for a bounce-back,” Patwa added.

According to market experts, FIIs have been cautious due to high valuations especially in the small and mid-cap space, while many are waiting for further corrections to buy stocks at more attractive prices.

The benchmarks have already dropped nearly 10 per cent from their all-time highs and FIIs expect an additional correction of 3-4 per cent. While current valuations—at a PE of 21-22 times—are slightly higher, they are not far from the five-year average of 19.5. A modest pullback could make Indian stocks more appealing to FIIs once again.

Nair says it looks like the muted performance of domestic Q2 earnings has been mostly factored in with the consolidation of the last 1-2 months. Market will look forward for improvement in domestic business and economy data, in anticipation of rebound in government spending which reduced during the year due to national & state elections.

In addition, technical indicators show that the market is in oversold zone, offering the possibility of a short-term bounce. However, with FIIs remaining net sellers and earnings reports falling short of expectations, the sustainability of any rally remains uncertain.

Ganesh Dongre, technical research analyst at Anand Rathi Shares and Stock Brokers says the market’s overall outlook remains bearish, as the Nifty has been unable to surpass its monthly highs of 24,500-24,600. However, as the index shows signs of being in an oversold zone, a sideways movement or even a bounce could be more probable in the coming weeks.

“For now, key support levels to watch this week are at 23,500 and 23,000, with resistance at 24,500–24, 600. For Sensex, key support levels are 77,000 and 75,500 and resistance are 79,500 and 81,500. FII data remains tilted toward selling, which signals a need for a cautious stance toward the market’s direction,” Dongre said.