One look at Anshuman Chakrapani and you know he is a family man—doting father, loving husband and a caring son. Employed with the Indian Railways, he moved back to Bhagalpur for family reasons and at 39, he is concerned over his retirement and the education needs of his children. Having suffered a life threatening disease in 2001, he is careful about his health and that is one of the reasons why he is also keen to get his retirement planned. A firm believer in yogic cure, he has taken to yoga, which he says helped him overcome his illness.

He feels there is a lot in common between yoga and investing as both require balance, flexibility and visualisation. Our planner warns that considering rising longevity and cost of living, planning towards retirement is of utmost importance. Considering he is 39, his current monthly expense of Rs 25,000 will shoot up to Rs 80,000 by the time he retires at 60, assuming a 6 per cent inflation. At present he has four people to support – his mother Asha Devi who is 59, his wife Ragini who is 29 and his two sons Shivansh and Divyansh who are 4 and 2 respectively.

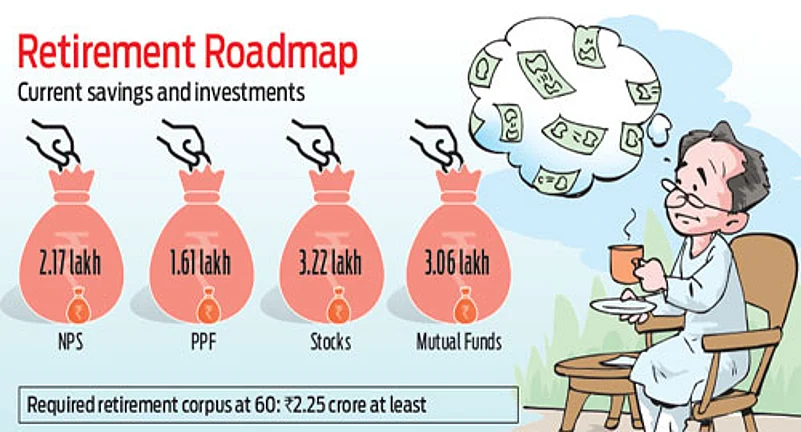

The good part for him is that he has already made a start and has invested in NPS, mutual funds and stocks. He also acknowledges the need to invest in equities to allow his money to grow. For protection he has adequate term plan, which he should consider increasing as his sons grow older. As he works with the Railways, healthcare costs will be taken care by them. Our planner has worked out a plan for him, which calls for Rs 7,300 to be invested regularly each month growing at a nominal pace of of 10 per cent to beat inflation and help him build his nest egg.

Solving the retirement puzzle

In order to accumulate a corpus which would be sufficient to cater to your rising expenses you need to start an automated savings of Rs 7,300 per month and increase the investments by 7 per cent each year. The assumption made to reach this figure is that your existing investment of Rs 10 lakh is only for retirement and assuming a 10 per cent return on your investments.