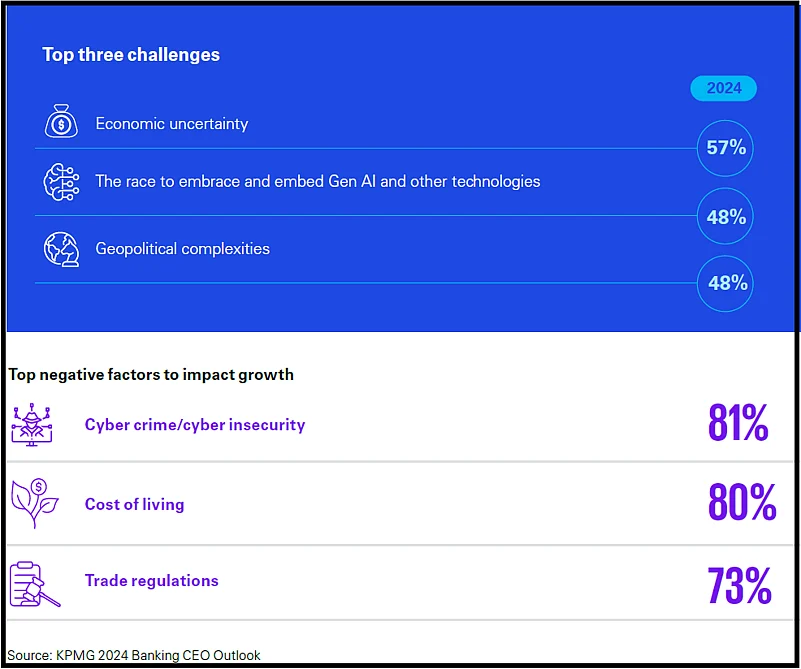

At a time, when most of the banks’ board members are betting on large investments in emerging technology, 81 per cent of Chief Executive Officers (CEOs) of various banks across the globe feel that cyber crime/cyber security is likely to be a top factor to have a negative impact on organizational growth over the next three years, according to the recent Banking CEO report released by KPMG in India.

With rapid evolution of technology and artificial intelligence (AI) , threats arising from them are also going up considerably. Only 43 percent say they are confident their organization’s cyber security plans can keep up with rapid AI advancements, and 72 percent state they are now raising their investment in cybersecurity to protect operations from AI risks.

The global survey also revealed that 81 per cent of the CEOs consider Gen AI as a top investment priority for their organization. 53 per cent of the respondents said they are well-prepared to tackle the challenges related to cyber security, as compared to 54 per cent in 2023. Notably, percentage of those who are unprepared to face these challenges have been dropped to three per cent as compared to 21 per cent in the previous year. However, 44 per cent of the industry leaders stated that they are now neutral on their level of preparedness against 23 per cent last year.

“Very soon, and very quickly, your ability to work faster and satisfy new client expectations will be very important, so you must face your technology challenges now and create the right capabilities,” said Francisco Uría, Global Head of Banking and Capital Markets, KPMG International.

Uría further suggested to start creating the channels for internal exploration, as well as investing in data quality, structures, governance and workforce skills.

Out of 120 industry leaders interviewed for the survey across the world, 76 per cent said that experimentation is key to unlocking Gen AI’s potential and they encourage all employees to take part. Meanwhile, 66 per cent said their respective organizations are equipped to upskill employees to leverage the benefits of Gen AI.

As 66 per cent of banking CEOs are confident in the growth prospects of the banking and capital markets industry over the next three years, talent also remain a key concern for them. The banking industry attempts to attract and retain professionals with the skills required to support technology-enabled transformation. This concern is exacerbated against a backdrop of an uncertain geopolitical and macroeconomic environment.

“The skills gap required across each of these areas is evident. Banks understand that they are now competing for new skills and capabilities in what is currently a challenging marketplace not just globally but here in India as well,” said Hemant Jhajhria, Partner and Head of Consulting, KPMG in India.

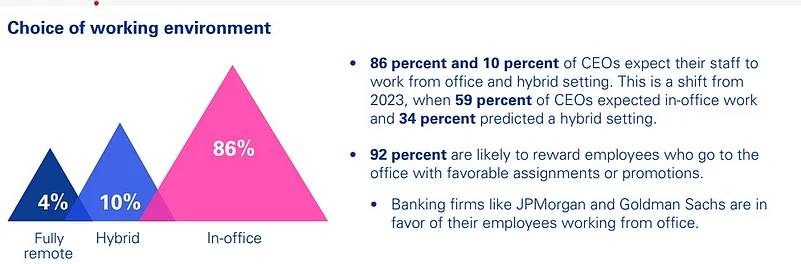

Notably, there is a sharp decline in the number of leaders who favor hybrid arrangements as only 10 per cent preferred this mode as compared to 34 per cent in the year 2023. In particular, 86 percent leaders now expect their employees from traditional in-office roles to return to work over the next three years. In fact, 92 per cent are likely to reward employees who go to the office with favorable assignments or promotions.

"Banks need to acknowledge that, in many markets, workforce attitudes have shifted dramatically, and next generation talent have different priorities. This cohort may favor employers that can offer personal mobility, flexibility and supportive workplace cultures,” Uría noted.

The respondents also identified knowledge transfer between employees as the top labor market factors impacting their organization followed by increasing retirements, a shortage of skilled workers to replace them, and a widening expectation gap between older employees and the younger generation.

The report highlighted that the CEOs also look at ESG (environmental, social, and governance) as an important driver of growth that will shape banks’ behaviors and investments. 58 per cent of respondents anticipate receiving a significant rate of return on their ESG investments within three to five years.