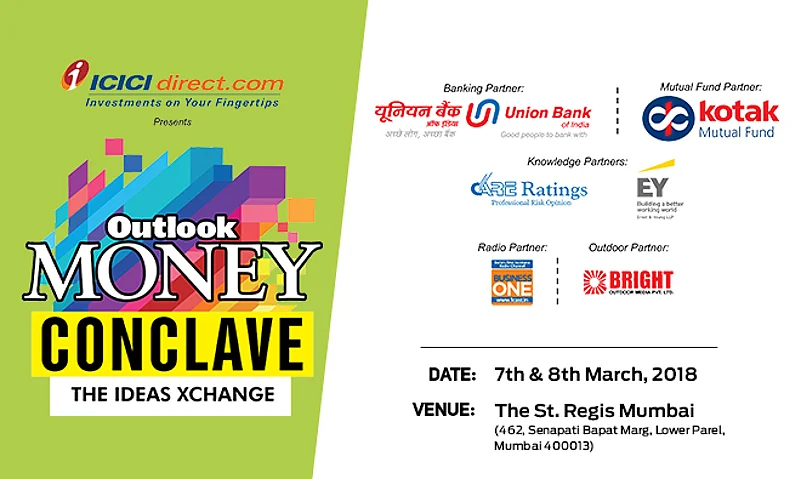

Outlook Money Conclave 2018 flags off on March 7, 2018. The event is spread across two days with a list of illustrious speakers engaging in different themes throughout the course of the event. The theme for the event is ‘Disruption and financial services’.

Speakers in the Conclave will participate on themes like ‘Banks of the Future- What will the Bank of the Future look like?’, ‘Online Broking- The E-Way Growth’, Distribution-Digital Footprints’, ‘Affordable Housing-The next big thing’, ‘Innovation in Insurance’ and ‘Mutual Funds- The Road Ahead’. The panel discussions will be followed by the Outlook Money Awards rewarding the excellence of the awardees in their respective fields.

The event is flagged off by the CEO of the Outlook Group.

According to him, the BSFI space is undergoing a marked shift due to policy and technology driven changes and the disruption is viewed as a threat by existing market leaders. But it is now being viewed as an opportunity.

The Outlook Money Conclave (#OLMConclave2018) will highlight some of these changes that will determine how a consumer will transact over times to come.

“That is why we decided to bring leaders of the industry together to exchange ideas, which will transform life of millions of customers in urban and rural India”, the CEO said.

“The one factor that every industrialist is worried about is disruption and the worry due to the tectonic shift due to technology and mobility”, he added.

Millenniums are the consumers that everyone seems to target but no one has touched the chord yet.

“Taking of disruption, how can we not talk of Fintechs. The new age fintech companies are challenging the existing leaders with their low cost and easy to deliver models”, he added.

With the Magazine Outlook Money and the #OLMConclave2018 we are trying to guide our readers with the principles of what is new in the financial services and marry these stories to real people, he concluded to flagging off the event.

Furthermore the editor of Outlook Money in her opening remark emphasized on the Technology and its impact on businesses and human behaviour. “Number of Facebook likes could determine credit worthiness. Social scores are increasingly used by lenders and financial intermediaries to determine credit worthiness of individuals”, she said.

Life insurers are detecting facial analytics and big data to determine life expectancy. If this works, the policy could be issued in the matter of minutes without requisite medical tests.

According to her, the future will be far removed from the past and for this reason, the @OutlookMoney has decided to look at some of these tectonic shifts that will shape not only consumers but even the institutional behaviour.

“Disruption is going to be the bedrock of everything we do and personal finance is going to be even more personal.

Over the next two days, we have lined up among the best minds to discuss, debate and engage on ideas that will power to determine our power tomorrow”, she added.

Focusing on millennium challenge, she added that the amazonization has resulted into quick deliverables and the BSFI industry is coping up to it.

“The vast amount of data that has been left by the consumers on various platforms is enabling the companies to understand the consumers in new way”, she said.

These conversations at OLMConclave2018 will not only bring you answers but enable you to raise new question relevant today.

The #OLMConclave2018 will be followed by the flagship event, Outlook Money Awards on the second day of the event, March 8.