That Indians love their real estate and gold is stating the obvious. This time, we analyse the finances of a family that has a very high allocation of investments in real estate and insurance. Like scores of Indians, Mumbai-based Sanjay V. Shirodkar is a die-hard believer in real estate and swears by investments in fixedreturn instruments. Yes, tangibility, predictability and low risk of capital in such investments exist, but they do not create wealth in the long run, at least not as much as one can with other investment options.

By having their money predominantly in fixed-return instruments and real estate, the Shirodkar family has narrowed its investment basket, which is highly concentrated in a single asset class. What’s more, with too much allocation to real estate, they also run the risk of illiquidity because money cannot be easily withdrawn from there. It will do them good if they can spread their investments across other financial instruments and reduce their investment risk.

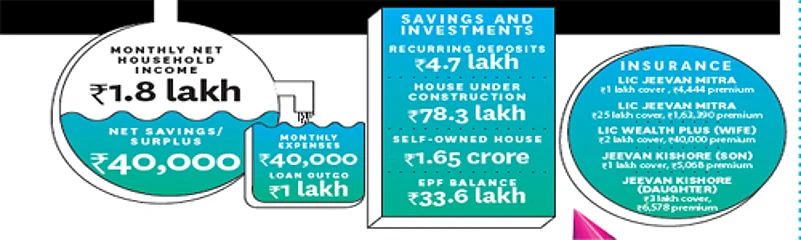

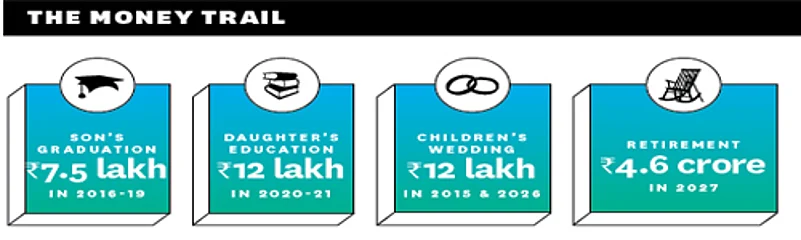

The Shirodkar family has Sanjay, 47, his wife Sukhada, 45, both working, and their two children Sohan, 17, and Sailee, 12. The family’s monthly income is Rs1.8 lakh, of which they spend Rs 40,000 towards household expenses and Rs1 lakh on three home loans, a personal loan and an auto loan, with the remaining Rs 40,000 as surplus. The family’s belief that they can build physical assets on borrowings is evident, and it has worked well, too. They live in a self-occupied house and have three under-construction flats, which will be handed over to them anytime. Upon possession, these flats will generate an additional income stream and let the family fund many of their financial goals.

Plans in place

Although the Shirodkars have no exposure to equity, their financial goals will fall in place to meet their objectives. However, the family is grossly under-insured, despite several life insurance plans. They seem to have approached life insurance more as a savings plan for future financial goals than just insurance. They should look at insurance, both life and health, more meaningfully because given their age and stage in life, their financial goals towards their children’s education, wedding, and their own retirement are yet to be achieved. Similarly, they also need to set aside funds to meet emergencies.

Focusing on savings is a good habit and will help the family assess their financial needs in a better way. However, the impact of inflation is a reality, which will not only eat into their savings, but also impact their financial goals. For instance, for a 60-year-old, if the return from a bank deposit was to underperform inflation even by just 2 per cent a year, the worth of the retirement corpus will be almost 50 per cent less by the time one turns 90.

And 90 is not an age that is impossible for one to reach these days, given the increasing longevity. Their savings in PPF and endowmenttype insurance plans that start to mature starting 2016 will meet their cash flow needs for financial goals that are approaching. Besides, their auto loan just got over in August 2015, leaving them with enough surplus to invest in equities. . With age on their side, it is still not too late to increase their overall equity exposure. They should start investing through Systematic Investment Plans (SIPs) in equity mutual funds.

Likewise, as they have four houses in all, including the one they live in, they could sell one of them in the future if they find income generation difficult and insufficient to meet the family’s financial needs.