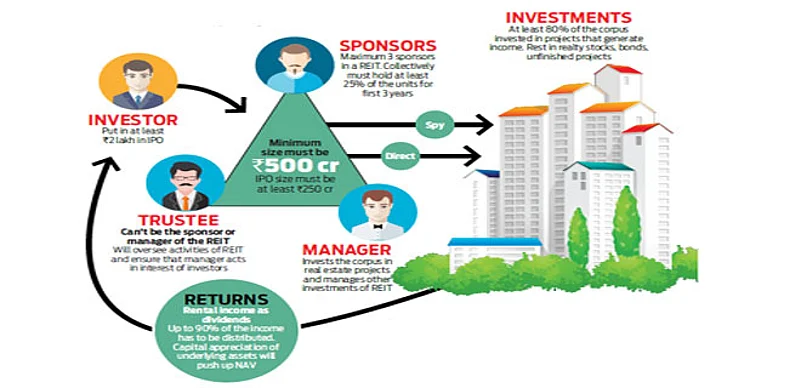

The minimum subscription size in REITs has been determined at Rs.2 lakh and the unit size is proposed at Rs.1 lakh. In India, a REIT will invest in commercial real estate assets, either directly or through special purpose vehicles (SPVs). In such SPVs, a REIT shall hold or propose to hold controlling interest and not less than 50 per cent of the equity share capital or interest.

One factor that swings the pendulum in favour of REIT is the fact that it is regulated by SEBI, which in turn has put in place three safeguards in its REIT regulations to protect investors’ interests that ensure their money, is safe.

But it’s still early, so a wait and watch approach is better. However, if you can stomach some risk and wish to diversify your real estate exposure, then you should explore this route.

“I recommend Uniworld and SmartOwner for different reasons. The former provides income and capital appreciation, whereas the latter provides capital appreciation,” says Bengaluru-based, financial planner B. Srinivasan.

Exercise choice with caution

Like every investment, safety of the product is crucial. The advantage with REITs is that they are regulated by SEBI. Going by the mutual fund concept of pooled investments that it is based on, REITs will also follow a benchmark. And although Uniworld and SmartOwner are not part of REITs, they are legally structured in a manner that they do not need to comply with SEBI or any other regulations. But, that is the case with any real estate project that you may put your money into, because of lack of regulations in real estate in India.

There is a lot of legal protection with REITs as they are required to register with SEBI, and there are investment restrictions on REITs (80 per cent in completed property, 90 per cent dividend payout, investments in at least 2 projects, approval for related party deals, and so on), put in place a basic governance structure to prevent mis-utilisation of funds. More importantly, REITs are required to start off with a minimum asset size of Rs.500 crore, which is already invested into identified property assets.

And, as sponsors are required have their own ‘skin in the game’ by investing 25 per cent of the initial corpus, there is a greater sense of safety when it comes to REITs. As an investor, things are in your favour: you finally have the choice to invest in real estate without putting in a lot of money or by borrowing huge sums.

You will also be able to follow the classic investing wisdom to diversify your investments to help you manage risk and rebalance to maintain your portfolio. There is plenty of merit in this statement going by empirical data that proves that a well-diversified portfolio which is rebalanced from time-to-time is a sure-shot route to wealth creation. “The goal of diversification is not to boost performance—it won’t ensure gains or guarantee against losses, but it will help you spread your money across asset classes and manage investment risks,” sums up Srinivasan.

Understand what you will face

PROS

Lower entry level: Investors will able to gain exposure to real estate with smaller amounts of as less as Rs.2 lakh

Investment window: Opens a wider investment basket for investors beyond debt, equity, commodities and money market

Safety: Since REITs primarily are for projects which are already built, it is definitely a safe investment and has lower risks compared to investing in under constructed projects

CONS

Cyclic in nature: One thing to remember is that like equities, real estate markets will face bull and bear phases

Limited window: Unlike mutual funds where one can invest a few hundred rupees, REITs call for a minimum Rs.2 lakh with 3-year lock-in

Hard to exit: Due to the large ticket size, even in times where the market is doing well, investors may find it difficult to sell and exit