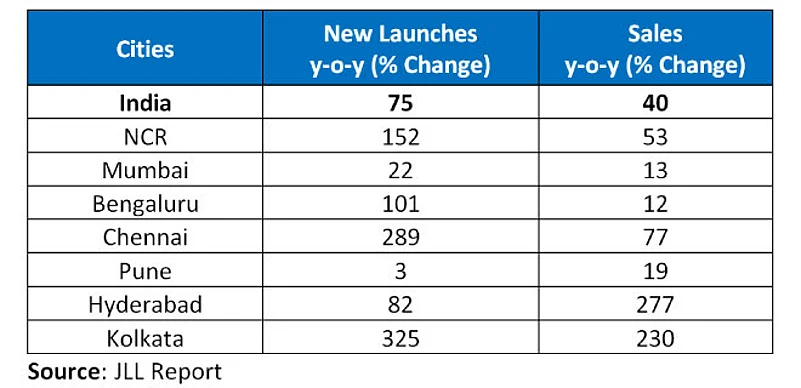

After suffering from moderate to severe slowdown in the recent past, there are some good news for the Indian real estate sector. This could be the result of painstaking reforms carried out in the economy as a whole and also for the sector in specific. As a result, the activity in the real estate sector has seen revival as new project launches (especially in the residential segment) across the country has increased by 75 per cent in the first nine months, i.e., from January to September 2018. In fact, the sales figure in the residential realty segment shot up to 40 per cent.

Jones Lang LaSalle (JLL), a leading global provider of real estate and investment management services, in its latest report said, the sector has begun to bear the fruits of game changing reforms in the form of demonetisation, GST as well as setting up of Real Estate Regulatory Authority (RERA) through a special Act. These reforms have helped change the country’s real estate landscape and the recovery of the sector is seen on the horizon.

- Hyderabad leads with 277% growth in sales among seven major markets

- Kolkata records a remarkable 325% on year increase in new launches

- Mumbai’s residential market on an upswing, launches rise 22%

While the residential sector witnessed significant impact of these reforms, there is strong growth momentum visible, the report stated.

According to JLL data, sales in residential segment have risen by 40 per cent at the end of third quarter ended September 30, of the calendar year 2018 (CY18).

Compared to last year, new launches during the same period registered a robust growth of 75 per cent. The data is based on performance of residential segment in seven key markets of National Capital Region (NCR), Mumbai, Bengaluru, Chennai, Pune, Hyderabad and Kolkata.

From the sales perspective, Hyderabad and Kolkata were the standout performers with growth rates of 277 per cent and 230 per cent respectively. An important factor behind the high sales growth numbers was the low base effect on the back of relatively small size of the residential market in both these markets. These were closely followed by Chennai (77 per cent), NCR (53 per cent), Pune (19 per cent), and Bangalore (12 per cent).

In terms of new launches, Kolkata led the way with an astounding 325 per cent on year growth followed by Chennai (289 per cent) and NCR (152 per cent) rounding off the top three. While Bengaluru and Hyderabad recorded growth rates of 101 per cent and 82 per cent respectively, Pune had a mere three per cent growth.

The residential market in Mumbai (that includes Mumbai main city, Thane and Navi Mumbai) too witnessed strong growth momentum during the period under consideration. It recorded 22 per cent growth in the number of launches and 13 per cent rise in sales, which is quite promising considering its high capital values.

While the implementation of GST and RERA led to some initial challenges for developers, most of the issues have been addressed and the sector as a whole is aligned. Going by the data for sales and new launches during the nine months period, home buyers are no longer delaying or postponing their decisions on buying homes. With developers, consumers and other important stakeholders in the sector having accepted realities of doing business of post GST and RERA, there is definitely an increase in confidence in the market amidst positive signs of recovery, the report stressed.

This coupled with stable pricing, augurs well for the sector and demonstrates the return of buyers’ confidence in the market, which has in turn prompted developers to launch new projects, the report said.

It concluded on an optimistic note and said, going forward, we will have to wait and watch on how this growth trend will crystallize in the future, but it is definitely the start of a positive growth story in the mid to long-term for the residential realty sector.