In one of his interviews, Jim Collins said, “Every giant company was once a start-up. Right in the middle of that progression is where the magic, or tragedy, really happens.”

For a mid-market or mid-cap company, scaling up can be a slippery slope. On one side, you are battling larger companies with more financial muscle and on the other end, you have young frisky start-ups threatening to disrupt your existing business landscape. And not to forget the unrelenting scrutiny of your financial performance by analysts and investors quarter after quarter, if you are listed. Thus, you’re juggling to cope with competition, disruption and liquidity challenges as you try and scale up your business.

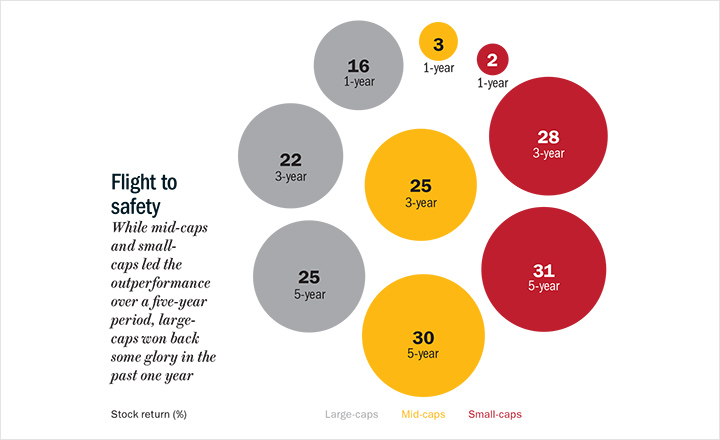

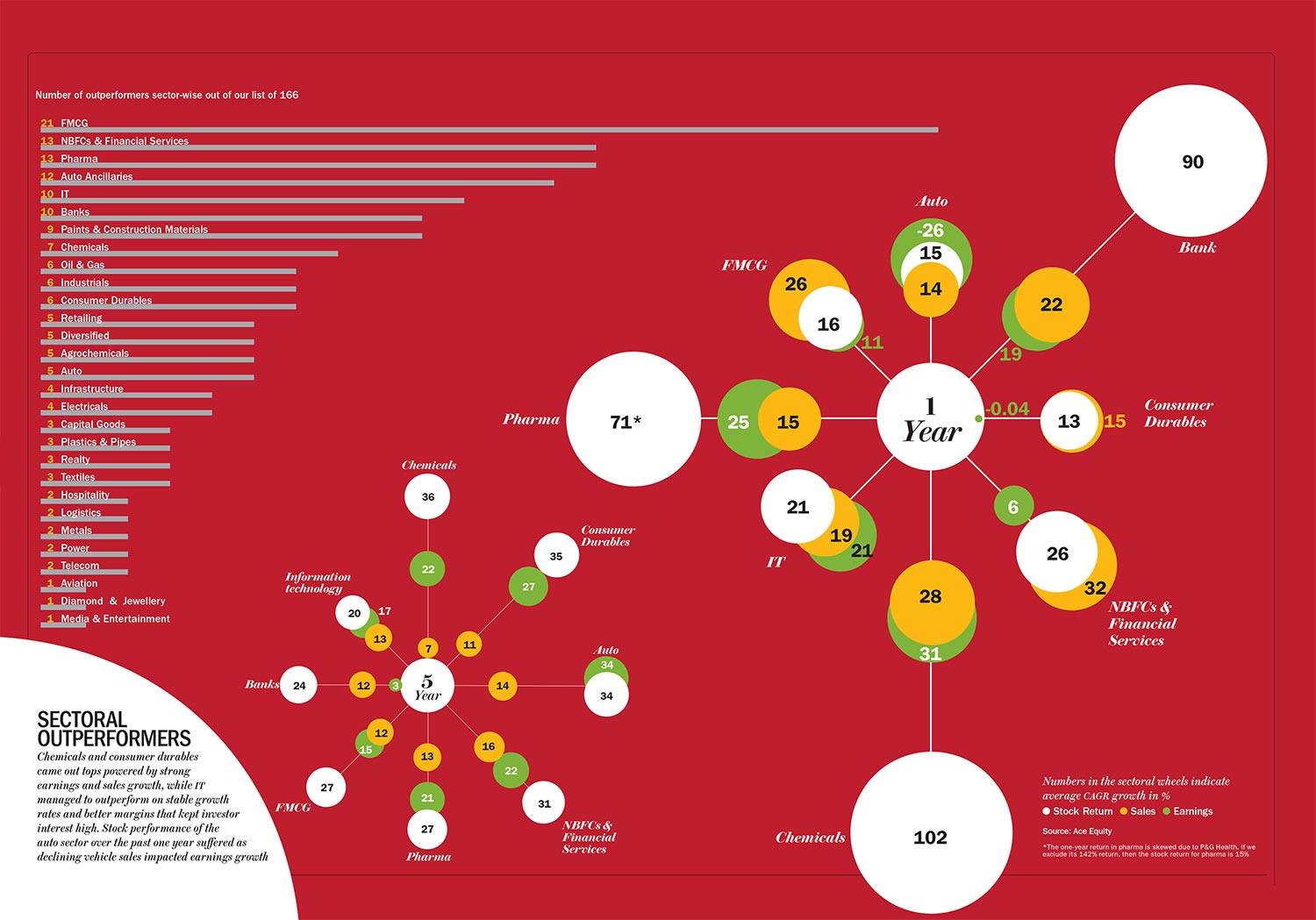

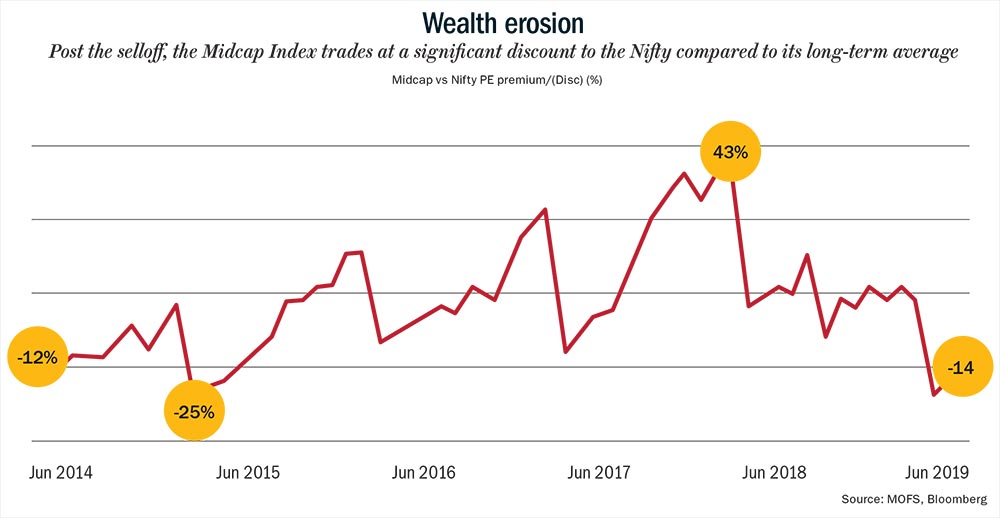

And just as we are partial to Jim Collins’ quotes, the market also took a shine to mid-cap companies over the past five years. So, it is not surprising that nearly 50% of our list comprises mid-caps. Add the small-caps in, and that covers three-fourths of our catalogue. This is despite the slaughtering they underwent a little over a year ago, when valuations hit frothy levels in December 2017. In terms of multiple, the CNX Mid-cap Index was quoting at 45% premium to the Nifty (See: Wealth erosion).

Things were heady till the global liquidity crisis hit and Sebi’s reclassification pushed funds to rebalance their portfolios, putting an end to the mid-cap party. Over the past year and a half, investors took refuge in large-caps on increasing concerns of economic slowdown globally. Manish Bhandari, CEO and portfolio manager of Vallum Capital Advisors, agrees. “The huge divergence of return between the large-cap and small-cap index is largely explained by concentration of capital in a few large-cap names at the expense of a wider basket of opportunity,” he says. But, even in that gloom, there were mid-caps with differentiated strategy or product offerings that bucked the trend. Bhandari notes that the market goes through such periodic divergences until investors separate capitalisation from business risk. He adds, “Investors need to evaluate risk-reward ratios in each set, carefully. Over a long period, value converges to well governed companies and businesses.”

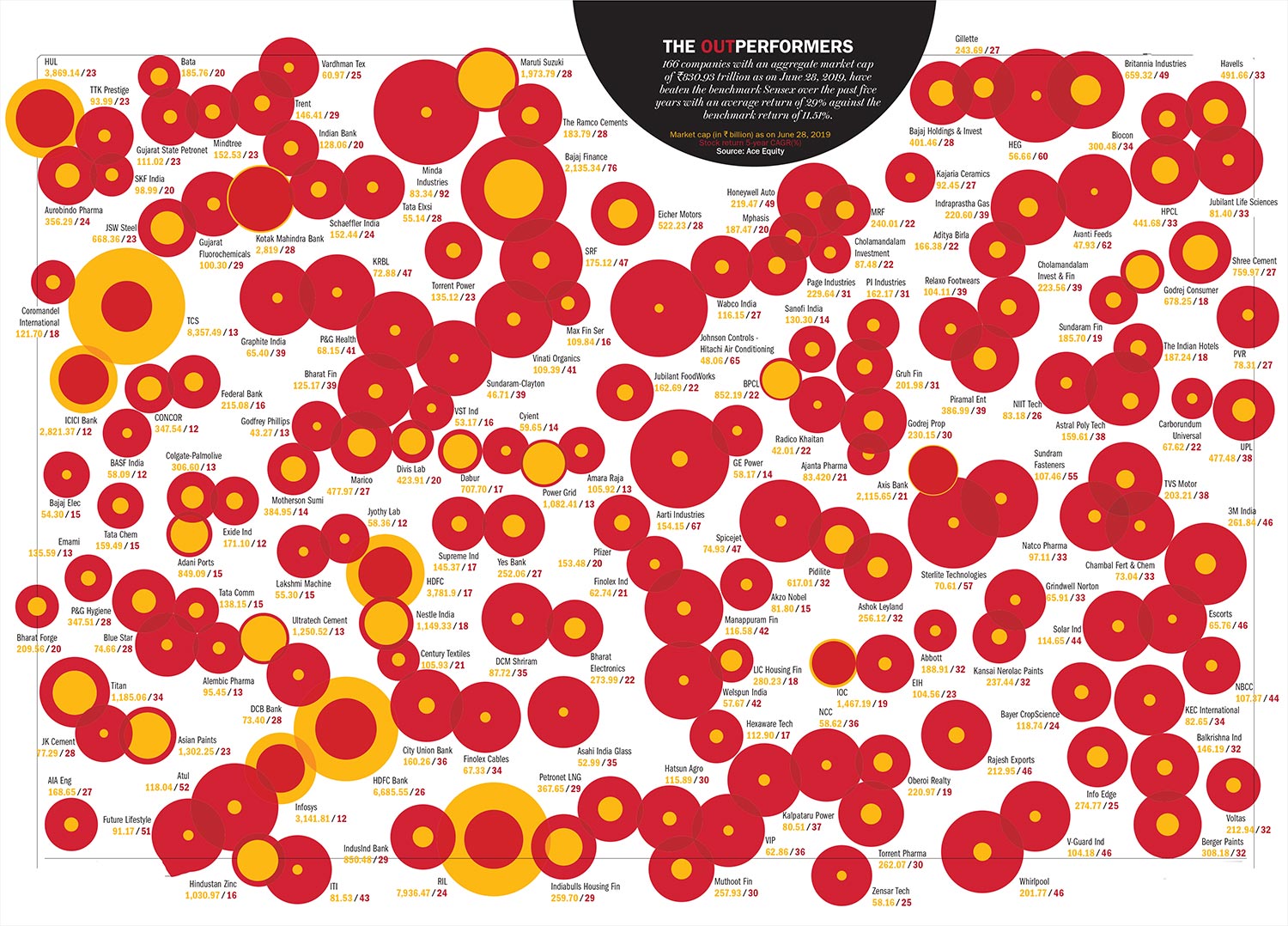

This is our third edition of The Outperformers, but for the uninitiated, this is how we find the winners. We take a closer look at companies that have managed to beat the market over a five-year period, creating significant value for their shareholders.

As a starting point, we zeroed in on companies with a market capitalisation of over Rs.50 billion on March 29, 2019 and looked at their compounded stock return from FY14 to FY19. The Sensex generated an annual compounded return of 11.51% during this period, and companies that outperformed the benchmark index formed our universe.

We have healthy representation from private banks and non-banking financial companies (NBFCs), reflecting their glory days before the crisis that imploded late last year. While it was a crisis of confidence in NBFCs, which then bore the brunt of a liquidity crisis, Bharat Iyer, head- India equity research at JP Morgan India, says, we cannot paint all NBFCs with the same brush. “The issues in this space are selective. It involves solvency or refinance problems for select companies, mainly with exposure to developer financing in the real estate and infrastructure sectors. There is no systemic liquidity issue, as seen in the performance over H2FY19 of the larger well-capitalised names across segments, be it housing finance companies (HFCs), consumer or auto finance,” he says. In fact, some NBFCs not only understand the niche segments that they operate in, they have also built specialised business models that work really well.

Take the case of Muthoot Finance, the largest gold loan NBFC in India, whose stock price has gained more than 50% since the NBFC crisis hit in October 2018, and touched its life-time high in the past one year. The firm that gets Rs.2.5 billion worth of repayments from its customers through its 4,400 branches across India, felt absolutely no pinch of the liquidity crisis. While it has been expanding its branch network, the focus is on consistently improving branch productivity. Thanks to that focus, Muthoot Finance’s branches are twice as productive as its closest rival Manappuram Finance’s. “Mid-cap companies that succeed in scaling up are very good at building individual units that are profitable. That unit could be a local sales team managing a market or channel, or the way they run their operations or manufacturing plants. They give the units enough flexibility and authority to become profitable and then replicate the model in other places,” says Alok Kshirsagar, senior partner, McKinsey.

Even as Muthoot Finance has been building on its momentum in the gold business, it has been expanding its non-gold business, finding niches in micro finance, insurance broking and vehicle finance. It has taken a conservative approach in expanding the business, rather than rushing after market share. Jim Collins would approve. He says that it is very important for mid-cap companies to be financially disciplined in good times, so that they can sail through, survive and prosper, and pull ahead of others in difficult times.

While being financially prudent when scaling up is paramount, building a strong franchise also helps companies catapult over the market cap curve. Take for example, companies such as Titan, Asian Paints or even Bajaj Finance, that have been able to expand in this manner by delivering superior customer experience compared to their peers.

Consumer-facing businesses have been featuring prominently in our list for the past three years. These businesses have always commanded a premium given their stability in growth and ability to generate strong cash flows besides showing the promise of creating profitable and scalable franchises.

For instance, Bata India has generated return of 87% over the past one year as its premiumisation strategy starts to pay off. The company has built a robust distribution network with over 1,400 company-owned stores and 140 franchisee stores as of FY19. Over the past two years, the company’s margin saw an impressive expansion of 520 basis points to 16% in FY19, on account of better revenue mix and operating efficiencies at the store level. Its share of premium products currently accounts for 30% of overall revenue. The company’s strong balance sheet with robust cash flow and negative working capital act as a good support for its expansion plans.

Similarly, in a largely commoditised $3-billion luggage industry, VIP Industries has successfully managed to transition from being a luggage company to a brand with about 50% of market share. The transition which began about five years ago was aimed at reducing VIP’s dependence on its flagship brand, by diversifying — Skybags (luggage and backpack), Caprese (handbags), Carlton (premium travel bags) and Aristocrat (entry-level luggage and backpacks) — to a more comprehensive product offering. The strategy paid off when the company’s revenue grew from Rs.9.73 billion in FY14 to Rs.17.85 billion in FY19.

Extensive distribution network, product innovation and brand-building initiatives gave it the ability to charge 20-30% premium over branded players. As a result, the company’s earnings compounded at a healthy 20% over the past five years. The strong growth in earnings led to RoCE doubling from 21% in FY14 to 42% in FY18. The market, of course, rewarded this performance with the stock generating more than 50% return over the past one year.

Increasingly, almost all sectors and companies are dealing with disruption that require them to change their business model, be it in IT, pharma, banking or auto and auto ancillaries. In IT, clients are driving the transition to digital and companies are now coming up to speed, beefing up their capabilities through acquisitions. But the digital transformation is allowing mid-cap IT companies a window of opportunity to compete with the large-caps, since the size of digital deals fall right into their wheelhouse. So, companies such as NIIT Technologies and Zensar Technologies also brought in CEOs from Tier-I companies, who not only revamped the sales team, but reoriented the organisation to aggressively go after larger deals. “Companies need to have organisational depth and competence to take them to the next level,” says Anoop Bhaskar, head-equity, IDFC Mutual Fund.

In some industries such as pharma and auto, regulations are dismantling business models. The price erosion in the US generics market is compelling pharma companies to look at specialty generics to make up for the loss in revenue. Not surprisingly, none of the companies that derive a significant chunk of their revenue from the US generics make it to our outperformers list. “You have to be smart about where you want to play and choose the right geographies and product segments to be in. Not only should they be structurally attractive, as a mid-cap company, you have to be able to leverage the investments of larger companies,” says Kshirsagar.

In pharma especially, the product portfolio and the markets companies go after can make a substantial difference to the return they generate. Take the case of Torrent Pharma, whose conscious decision to stay away from the US market and allocate more resources to brand-partial markets such as India and Brazil, paid off. It helped the company offset growth headwind it was facing and increase its revenue by 55% in the past one year. It is way ahead of its peers today. Torrent Pharma generated an impressive compounded return of 30% over the five-year period.

While troubles hit pharma out of the blue, and in the shape of a theatrical US President, it came to the auto industry electrically charged. They were caught unaware by the central government’s massive and sustained push towards electric vehicles (EVs). Our list has these companies, which fall in the cyclical sector and have seen four good years and one bad from the slowdown in consumption demand. They are adept at handling these up-and-down turns, but it would be interesting to see how they are handling this change in policy. It will first be rolled out for two-wheelers and three-wheelers and then commercial vehicles. A report by Kotak Institutional Equities has forecast that about 28% of the automobiles (except CVs) will shift to electric and plug-in hybrid by 2030 with scooters, three-wheelers and buses making the transition faster than modes of transport.

Auto ancillaries will also need to pivot their business model with the transition to EVs as you no longer need engines and there is reduction of transmission, which is 60% of the cost in vehicles with internal combustion engines. However, companies such as Minda Industries, Bosch and Wabco are making those changes ahead of their peers. According to Spark Capital, Minda Industries, which topped our outperformers list this year, has made a deliberate transition into product categories (sensors and controllers) and technologies that are poised for imminent and speedy penetration. The company’s tie-up with global tech partners gives it access to cutting-edge innovation. Meanwhile, its dominant market share in most of its product categories increases its competitive advantage and its clients’ dependence on it, including big names such as Maruti, Bajaj Auto, BMW, Hero MotoCorp, M&M, Honda Motor and others.

IDFC MF’s Bhaskar says that a majority of the businesses are likely to remain cyclical and their outperformance will continue despite occasional hurdles. “Good investing is about understanding these cycles really well, and not getting carried away at the peak or selling during the downturn,” he says.

It is a shaky world, but Saurabh Mukherjea, founder of Marcellus Investment Advisors, offers one certainty. That you cannot go wrong if you invest in sector dominators. “Valuations don’t matter when you buy into outstanding franchises. In India, about 80% of the profit is controlled by one or two companies in most sectors, and you continue to make money as the Indian middle class continues to chug forward.” He says, rather than looking for value and investing in second-rung companies, investing in market leaders is far more rewarding.

“You don’t really have to worry about economic cycles or global scenarios once you determine the sustainability of the sector domination and check if the earnings compounding is steep,” Mukherjea explains, giving examples of HDFC Bank, Asian Paints and TCS. As the economic growth scenario starts to look a lot more challenging, significant outperformance may be difficult to come by in the next one to two years. While a rising tide will pitch and sway all boats, it is companies that have managed to create strong franchises that will forge ahead.