The Indian rupee slipped over 0.33per cent against the US dollar following the announcement of the US presidential election results on November 5. Experts suggest the Reserve Bank of India (RBI) may be deliberately allowing the rupee to fall to keep the country’s exchange rate competitive against global peers like China. Further, the rupee has hit a new low of Rs 84.4450 as the Adani saga and the escalating Ukraine-Russia conflict continue to strengthen the dollar, particularly against most Asian currencies.

Donald Trump's presidency has reignited concerns about trade tariffs and export restrictions. With fears of stiff duties on imports into the US, a weaker rupee could make Indian goods cheaper and more attractive potentially boosting exports. But it could also drive up its import bills for essentials like oil.

China, a major competitor in global trade has already reacted to Trump's return with a 1 per cent devaluation of its yuan. Reports suggest that Beijing might allow further depreciation if Trump implements his promise (threat) to slap tariffs of up to 60 per cent on Chinese imports. Such moves are expected to reverberate across Asia, impacting currency values and trade dynamics.

The Currency Competition with China

Experts argue that India must respond strategically to maintain its trade position. "There are two key factors influencing currency value: Fundamentals like demand and supply and the Global strength of the dollar. When the dollar strengthens, currencies across the board tend to depreciate," explains Madan Sabnavis, Chief Economist at Bank of Baroda.

India's trade deficit with China, which has nearly double over the last three years, to $83 billion in 2023 adds to the complexity. During Trump's previous tenure his administration imposed $250 billion in tariffs on Chinese goods, causing US imports from China to decline by over 14 per cent between 2017 and 2020.

"China has introduced economic stimulus measures to counter the dollar's strength, allowing its currency to weaken and maintain its export competitiveness," Sabnavis added

This presents India with a dual challenge. While a weaker rupee could attract businesses looking to relocate supply chains from China, it also heightens competition in shared export markets. "With the Yuan weakening, India must let the rupee depreciate to remain competitive," Sabnavis told Outlook Business.

How Much Could the Rupee Depreciate?

A recent report from the State Bank of India predicts that the rupee might depreciate against the USD by as much as 10 per cent during Trump's second term. Economists believe that the rupee is currently overvalued, leaving room for a controlled decline

The RBI analysis of the Real Effective Exchange Rate (REER), a measure adjusted for price differentials between trading partners, indicates that the rupee is overvalued by 16 per cent with a REER of 115.9 as of September 2024. A fair valuation would be closer to the base value of 100.

India’s substantial forex reserves of $675.6 billion allows for some depreciation without destabilising the economy said Dr Manoranjan Sharma, Chief Economist at Infomerics Ratings.

Gaura Sen Gupta, Chief Economist at IDFC First Bank echoed this sentiment noting that "RBI interventions have focused on reducing volatility rather than maintaining a specific exchange rate level. Depreciations are driven by narrowing balance of payments, widening trade deficits and foreign portfolio outflows. We expect USD-INR to reach 85.50 to 86.00 by September 2025," she said.

Dollar Strength And Global Trade

Trump's anticipated policies, including aggressive tariffs and protectionism under his America First agenda are expected to strengthen the dollar. Economist believe this could slow the US Federal Reserve’s rate-cutting cycle in 2025, creating inflationary pressures globally.

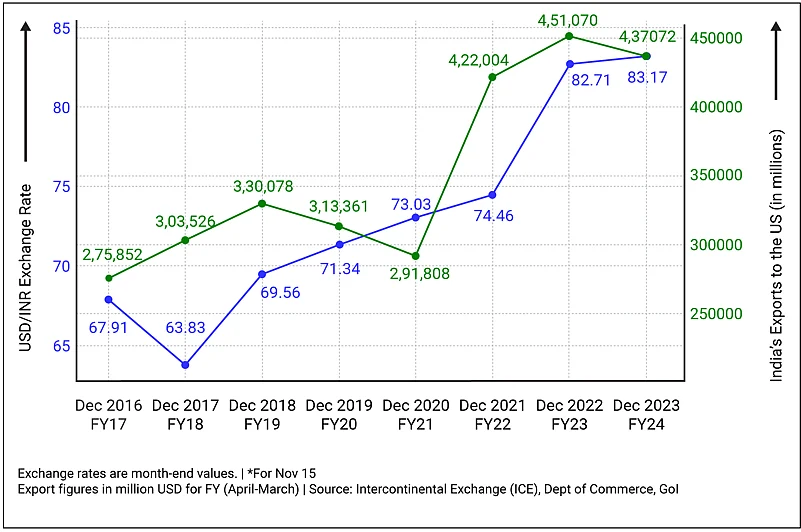

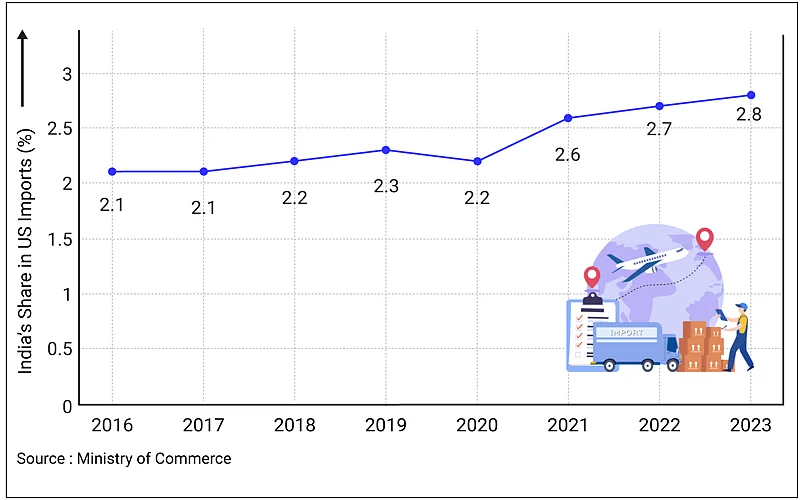

Despite this, India's export performance during Trump’s first term offers reasons for some optimism. Between 2017 and 2021,India's exports to the US surged by over 39 per cent even as the rupee depreciated by more than 16 per cent.

A weaker rupee enhances the competitiveness of Indian exports but it also raises the cost of imports particularly of essentials like oil and gas. These imports are price inelastic, meaning their higher costs directly impact trade, fiscal and current account deficits.

"The cascading effect of higher oil prices hits multiple industries, ultimately burdening customers," explain Sharma. While inflation affects everyone, the impact is particularly hard on salaried employees, pensioners and fixed income groups."

The shift in US-China relations under Trump could create opportunities for India. With the US looking to reduce reliance on Chinese imports, Indian sectors like IT, manufacturing and pharmaceuticals, stand to gain. “Protectionist measures will escalate US-China tensions opening doors for India to benefit from supply chain diversification," said Jahnavi Prabhakar, senior economist at Bank of Baroda.

Balancing Act for India

While India is poised to benefit from a weaker rupee in terms of exports and supply chain realignments policymakers must carefully managethe accompanying risks. Inflation, triple deficits and rising import costs need to be contained to ensure economic stability. As the Global economic landscape shifts, India's ability to navigate these challenges will determine its position in international trade and long-term economic health.