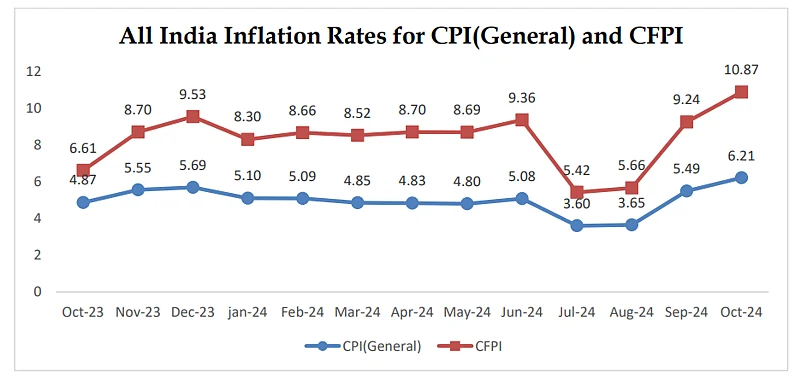

India's retail inflation shot up to 14-month high of 6.21 per cent in October 2024. This surprising spike in inflation is likely to pose a significant threat for the Reserve Bank of India's (RBI) aim to maintain price stability in the market. This surge also weakens consumers’ purchasing power and leaves a negative impact on the country’s overall demand, ultimately denting the economic growth.

The central bank, which primarily considers Consumer Price Index (CPI) to guide its bi-monthly monetary policy decisions, has been tasked by the government to ensure retail inflation remains at 4 per cent with a margin of 2 per cent on the either side. However, the National Statistics Office data revealed that CPI breached the upper limit of the MPC’s medium-term target range of 2-6 per cent.

Hence, experts believe that the central bank is unlikely to cut rates this year as reducing interest rates could fuel increasing demand, leading to even higher inflation. Currently, the RBI has kept the repo rate elevated at 6.5 per cent to keep inflation contained.

“The RBI is expected to remain cautious, with rate cuts unlikely before February 2025. The FY25 CPI target remains at 4.6%, contingent on easing food inflation and stable geopolitical conditions,” said Arsh Mogre, Economist at Prabhudas Lilladher

Considering the high food inflation majorly due to vegetables and fruits prices, Dhiraj Nim of ANZ Research asked, “Should the RBI nevertheless hold rates unchanged, keeping costs for the economy high for a few vegetables, especially when it is becoming clearer that growth will likely undershoot their forecasts?”

The economist stated that a sufficient decline in current inflation and the alignment of outlook with target 4% is necessary for the RBI to cut rates, especially if the growth is holding up well in the country. “Governor Shaktikanta Das has insisted “neutral stance” in one meeting doesn’t mean a cut in the next, and has maintained his line on wanting to see inflation decline first,” he reminded in a post on LinkedIn.

Nim opined that rate cuts may get delayed and October CPI data has upside risks to FY25 inflation, especially when vegetable prices have not eased enough to provide much relief to consumers in November 2024.

Will Food Inflation Ease This Fiscal?

According to official data, food inflation was at 10.97 per cent in October 2024, while vegetable inflation was at 42.18 per cent. In India, food prices have always been a critical pain point for policy makers who wish to bring retail inflation to 4 per cent. But the latest data reaffirms that the inflation has not aligned with the intended target. Moving forward, all eyes will be on the Kharif harvest season and progress in Rabi sowing next year.

“We expect the Monetary Policy Committee (MPC) to hold rates steady in December, given the recent sharp rise in food inflation. We also expect food inflation to ease this fiscal as Kharif sowing has been healthy. Vegetable prices can correct sharply when fresh stocks enter the market. So, we expect the MPC to cut rates towards the end of this fiscal,” said Dharmakirti Joshi, Chief Economist of CRISIL.

Elara Securities also expect moderate vegetable prices in the next few days due to arrival of Kharif crops in the market and favourable Rabi sowing conditions. “There is unlikely to be any meaningful moderation till mid-November. This means when MPC meets in December, it shall little comfort from the food price data, thereby ruling out December 2024 rate cut,” it said.

The brokerage firm added the recent sharp depreciation of the rupee, along with FII outflows are likely to exacerbate RBI’s task of managing external sector pressure amidst elevated inflation print. It expects 25bp cut in February 2024 if the CPI surprises on the downside or even remains within the RBI’s estimates.

Aditi Nayar, chief economist at ICRA anticipated that the food and beverages inflation will ease to 8-8.5 per cent in November 2024 from 9.7 per cent in October 2024. In addition, the headline inflation is also expected to soften to 5.5-5.7 per cent this month, according to the rating agency predictions.

“With the CPI inflation expecting to exceed the MPC’s estimate for Q3 FY25 by at least 60-70 bps, a rate cut in the December 2024 policy review appears ruled out, in spite of our projection of a sub-7 per cent GDP growth print for Q2 FY25,” she added.

The central bank has earlier predicted that India’s real GDP growth and CPI inflation for FY25 is expected to grow at 7.2 per cent and 4.5 per cent respectively.