From the weddings of Radhika-Anant, Deepika-Ranveer, Anushka-Virat and Priyanka-Nick, Indian weddings have always been lavish. As the Indian wedding season kicks in, we delve into the economics of Indian marriages and how they drive consumption in the country.

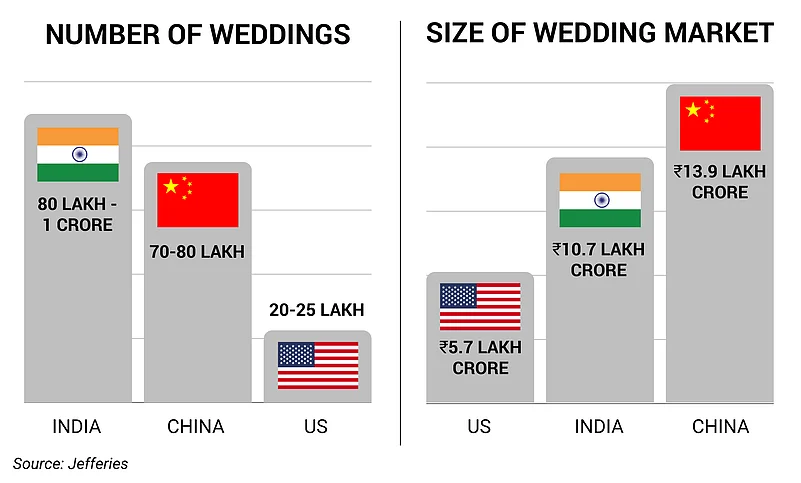

India hosts the highest number of weddings in the world each year, as per investment banking and capital market firm Jefferies. However, in terms of market size, the Indian wedding industry is still smaller than China’s but almost twice as big as the US’s.

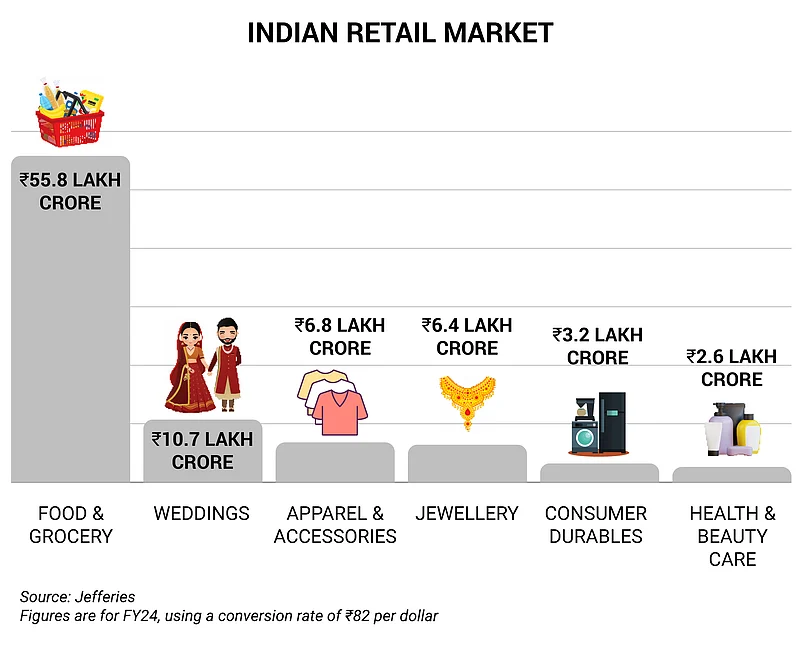

However, domestically, when compared with other retail industries, the wedding sector ranks second in size, after the food and grocery industry.

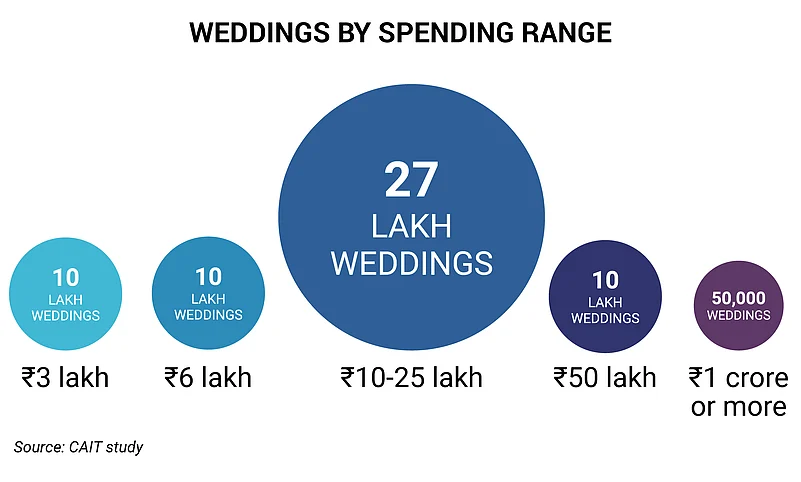

According to research by the Confederation of All India Traders (CAIT), India is expected to see 48 lakh weddings in November-December 2024, generating about ₹6 lakh crore in business.

Out of these 48 lakh weddings, about 40 lakh will be budget-weddings (Rs 3 lakh to Rs 15 lakh), while around 50,000 weddings will be luxurious with a spend of Rs 1 crore or more.

An otherwise cost-conscious society, Indians love to spend big on weddings to make the event unforgettable. This tendency to go over budget is common across all income groups in India.

The Jefferies report states that an average Indian family spends Rs 12 lakh on a wedding, which is three times their yearly income of Rs 4 lakh. In contrast, they only spend around Rs 6 lakh on educating their child for 18 years (from pre-school to graduation).

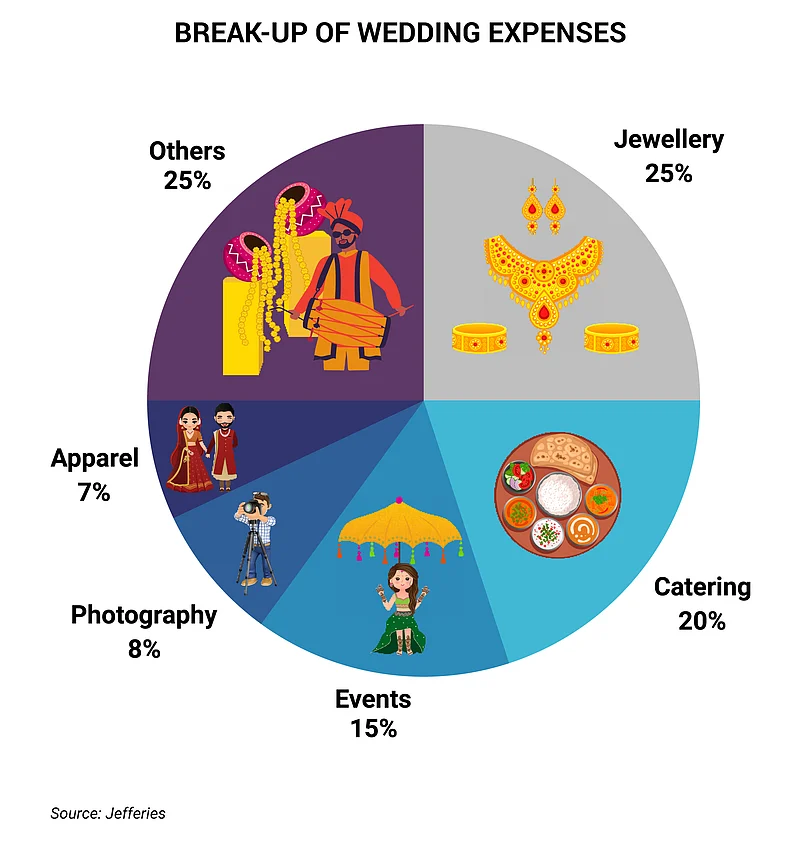

Breaking down wedding expenses, jewellery takes the largest share at nearly 25 per cent, followed by catering at 20 per cent and events at 15 per cent.

According to a report by the Ministry of Commerce and Industry, the Indian wedding industry provides jobs to about 1 crore people including caterers, decorators, photographers and videographers, make-up artists, wedding planners and musicians.

Weddings also help boost several other sectors, like clothing, jewellery, automobiles and consumer durables. These industries see higher demand during the wedding season, with companies carefully timing their promotions and stock management around wedding dates.

More than half of the jewellery industry’s revenue comes from bridal jewellery, while weddings and celebration wear drive 10 per cent of all apparel spending.

While the Indian wedding industry is largely fragmented and unorganised, there’s room for big players to grow their share. For instance, Titan and Kalyan Jewellers typically benefit from the wedding season. Other major brands in this market include Aditya Birla Fashion, Matrimony.com, Indian Hotels Company, and IndiGo.