The Indian Rupee fell to a record low of 84.07 against the US dollar on October 22, 2024, according to the Intercontinental Exchange (ICE).

The rupee is facing pressure due to increased dollar demand coming from elevated crude oil prices and the continuous withdrawal of foreign funds from the domestic equity market.

In late September, China’s central bank announced bold monetary support measures to boost its struggling economy. These steps led foreign investors to change their stance on China. However, the positive outlook for China has come at the expense of India.

Data from the stock exchange shows that in October, foreign institutional investors (FII) sold Indian stocks worth over Rs 90,000 crores on a net basis. The outflow in October exceeds the monthly outflows seen during the Covid-19 pandemic in March 2020.

The strategy of ‘sell India, buy China’ is increasingly gaining momentum among the investor community. One reason for this is that Chinese stocks are available at cheaper valuations than Indian stocks. Nifty50, India's benchmark stock index, is trading at 23.4 times its 12-month price-earnings, while China's CSI 300 is trading at 13.4 times.

This can be seen in the performance of the stock markets. China and Hong Kong’s stock markets have shown double-digit returns in the past month compared to the Indian stock market which has registered a negative return of about 6 per cent during the same period.

Foreign investors receive dollars on selling the shares, thus pushing up the dollar demand and weakening the rupee. Another factor driving up the demand for dollars is the rise in crude oil prices.

The oil price is rising due to a tight supply caused by two key events in October—Hurricane Milton in the US and the Israeli PM’s vow to make Iran “pay" for firing missiles at his country.

India relies on oil imports to meet its energy needs, with an annual bill of over $132bn. Domestic oil companies need more dollars to cover these imports when oil prices rise.

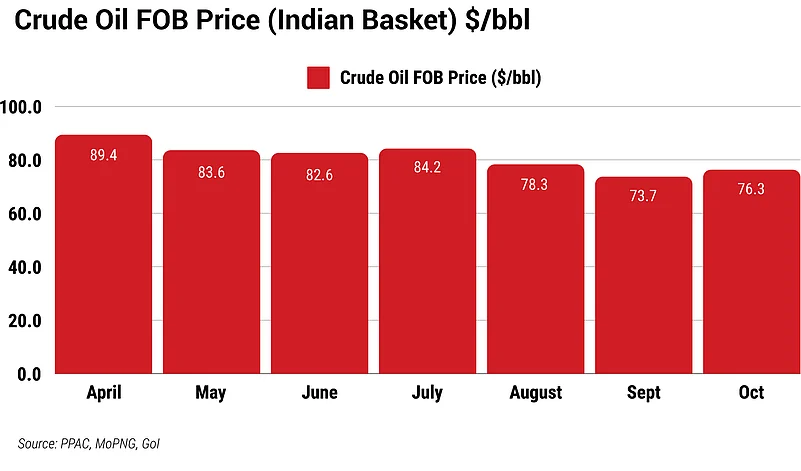

According to data from the Petroleum Planning and Analysis Cell of the Union Ministry of Petroleum and Natural Gas, the price of crude oil (Indian basket) reversed in October after witnessing a decline for several months.