Asian Paints Share Price: The faltering demand play once again casted a shadow over the earnings season. Asian paints' volume growth went into the negative territory, declining by 0.5 per cent year-on-year, as unfavourable weather and subdued consumer sentiment weighed heavily on the bottom line.

While the demand outlook remains largely muted, things seem worse for the company as the decline was sharper than its peers, who witnessed a growth rate of anywhere around 3-5 per cent.

But a major letdown for investors was Asian Paints' net profit figure, which dropped sharply by nearly 42.4 per cent to Rs 694.6 crores as compared to Rs 1,205.42 crore reported in the corresponding quarter of the previous year.

The not-so-impressive figures sent the share price of the company plummeting to nearly 9 per cent on the National Stock Exchange on Monday. On year-to-date basis, as well, the shares have remained under heightened pressure, declining by almost 25 per cent on the bourses.

No doubt, the demand picture is surely acting as a major dampener, but there is another factor that is adding to the stress- margins.

The Margin Play

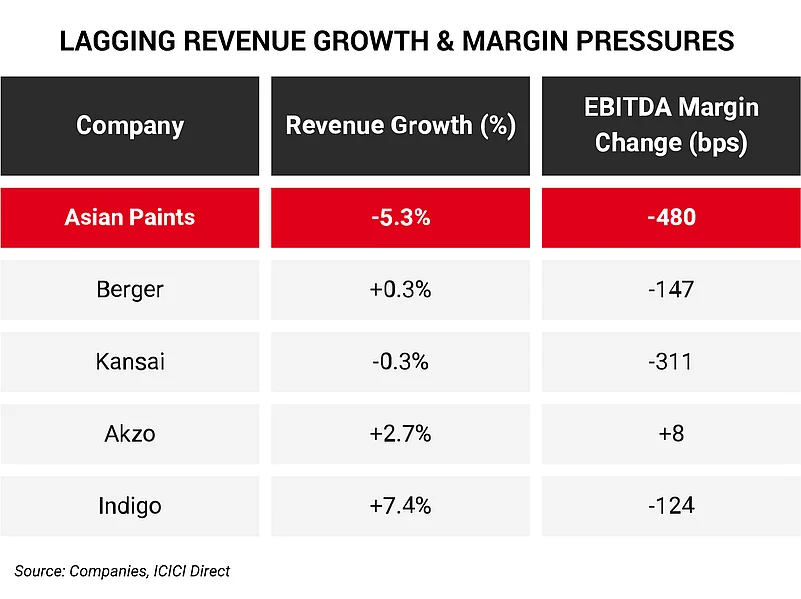

In Q2FY25, Asian Paints saw a noticeable drop in its profitability, with its gross margin shrinking by 2.59 percentage points and its Ebitda margin declining by 4.8 percentage points year-on-year.

One of the reasons contributing to the drop was the company's decision to lower product prices. Plus, the surging input prices also took a toll on the already-muted earnings.

"We believe carryover price cut of 4 per cent and higher input prices at the beginning of Q2FY25 resulted in lower margins year-on-year. The company has also raised prices by 2.5 per cent during Q2FY25," ICICI Securities stated in a report.

As of now, the company has increased the costs of the product but the overall impact will only be seen in the upcoming quarters.

Apart from this, prolonged rains and floods in certain areas coupled with higher spending also added to the margin woes. On the international business front, the company experienced a marginal value decline owing to tough market conditions in Ethiopia and Bangladesh. However, revenue growth remained steady at 8.7 per cent on constant currency basis.

The management expects the margins to bounce back in Q3 as the impact of the price increase is visible on a large scale.

"While we took price increases during the quarter, the full impact of the same should flow through only in the second half of the year. Soft demand conditions, product mix and material price inflation affected margins in Q2. We expect margins to recover in the coming quarters on the back of anticipated softening in material prices coupled with price increases implemented in the last few months," said Amit Syngle, Managing Director and CEO of Asian Paints.

The intensifying competition in the paint industry, especially with the entry of Birla Opus, appears to have added to the challenging outlook. While Opus is still at an initial stage of its launch, other mature players in the industry like Berger and Kansai are definitely making things difficult for Asian Paints.

The company lagged behind all its peers in revenue growth. Even the drop in Ebitda margins was the steepest among them.

What's the road ahead?

While headwinds still remain well-present in the industry primarily owing to the urban demand play and fluctuation in the prices of raw materials, the company is expected to focus on "leveraging its brand strength and distribution network to pursue growth," Syngle said in an exchange filing.

Besides this, Asian Paints had to adjust business plans for two of its majority-owned companies, Weatherseal and White Teak, which led to an impairment in value.

Major brokerage houses believe that growth outlook might remain subdued in the upcoming quarter as macroeconomic factors and heightened competition continue to pose difficulty on the recovery side.

Nomura has maintained a Neutral rating on the company. "We expect Asian Paint’s margins (and other players also) to improve from 3Q with softer input costs seen at end of 2Q, better product mix and the full impact of price hikes taken in 2Q," the brokerage house said.

ICICI Securities, on the other hand, has maintained its Reduce rating forecasting a 4 per cent annual growth in revenue and a 9.9 per cent annual decline in profit over FY24-26E.

"We believe the impact of increase in competitive pressures may continue to hurt profitability. We believe Asian Paints could post YoY earnings decline in FY25 after a gap of almost 17 years," the brokerage firm said in its report.