In the discussions around India’s long-term growth trajectory, the country’s digitalisation push is often touted as a key driver. Its smartphone market, which is the second largest in the world, is expected to triple from its current levels to $90 billion by 2032, according to global financial services provider Morgan Stanley. For believers in the India growth story, like Apple CEO Tim Cook, this is great news.

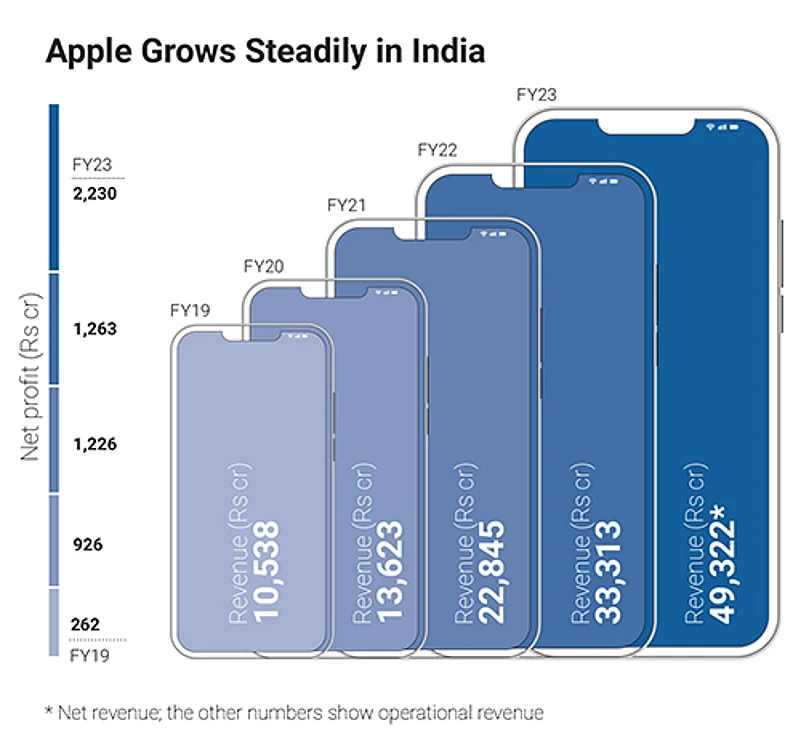

In 2017, during a quarterly earnings call, the Apple chief had said that he was “very, very bullish and very, very optimistic about India”. In the subsequent years, it seems that the Cupertino-based company’s India bet is paying off. For FY23, Apple’s India operations reported a 48% annual revenue growth, almost touching $6 billion. More importantly, the company’s market share is estimated to rise from 4.5% last year to 7% in 2023. If all goes well, the tech major would be able to rake in $10 billion annual revenue from India this fiscal. So, how did the world leader of expensive smartphones tap into the price-sensitive market of India?

Cracking the Premium Code

The average selling price (ASP) of a smartphone in India is now at $253, approximately Rs 21,000, which is a 12% rise from the same period last year, according to International Data Corporation. The data shows that it is the premium segment—above $600—that has been showing the most growth for the past few quarters. The smartphone market is evidently experiencing a premiumisation wave, although the ASP is low compared to global standards. Experts suggest that a key ingredient behind Apple’s success in India has been the Indian aspiration to own more expensive devices.

“With the highest-ever quarterly shipments in Q3 2023, exceeding 2.5 million units, Apple has successfully tapped into the rising trend of premiumisation in India. The ultra-premiumisation trend is steadily gaining momentum with each passing quarter,” says Shilpi Jain, senior analyst at Counterpoint Research, a technology market research firm. In Q3 2023, the segment grew 44% year-on-year, driven by the availability of easy financing options, implementation of various incentive programmes in the market and growing consumer aspirations for the latest technology, she points out . “The company (Apple) has been leading the Indian premium smartphone market for past three years (2020–2022) and is expected to maintain its leading position in 2023 as well,” she adds.

India is now the fifth biggest market for Apple’s iPhone, behind only the US, China, Japan and the UK. Just as is the case in China, the iPhone need not achieve a majority of the market share in India to significantly bump up its business prospects here. According to latest available data from Counterpoint, Apple accounts for 16% of the Chinese smartphone market. In India too, its target will be to reach a double digit market share as the ASP of smartphones continues to increase in the country.

“India’s importance as a market for Apple has increased due to the country’s vast consumer base, with over 850 million mobile phone users, and the potential to reach over a billion smartphone users in the next five years. Apple strategically targets this growing market, particularly the upper middle-class segment, presenting an opportunity for millions of smartphone sales annually. The ability to cross-sell other products and services to the expanding iPhone user base further maximises revenue opportunities,” says Jain.

From India, For the World

More than its consumption market, Apple’s relationship with China hinged on the fact that it has acted as a hub of the technology maker’s manufacturing operations. But now, with China turning up its hostilities against the American company, India is on the Apple radar due to its manufacturing ambitions as well.

India has set high targets for itself in ramping up its mobile-making industry. Initiatives such as the production-linked incentive scheme and the Make in India campaign have already helped the country increase the share of locally manufactured phones in overall shipments from 19% in 2014 to 98% in 2022. Apple too has experimented with iPhone production in India and looks set to increase its manufacturing operations in the country.

In 2017, the iPhone SE became the first iPhone to be produced in India, by Apple’s contract manufacturer Foxconn. Fast-forward to 2023, 7% of all iPhones is being made in India. Bank of America forecasted earlier this year that Apple will move more than 18% of its global production of iPhones to India by 2024–25.

Not only will that help India become a major player in the phone-making world, but it will also help Apple de-risk its operations from the uncertainties it experiences in China. The latest iPhone 15 and 15 Plus devices made in India were available for sale across the world on the same day that the made-in-China devices went on sale. It was the first time that India-made iPhones went on sale on the first day of global sales.

Jain of Counterpoint Research says, “The decision by Apple to manufacture its latest iPhones and AirPods in India supports the Make in India initiative, enhancing cost efficiencies and local production capabilities. This move not only helps Apple navigate import challenges but also strengthens its local footprint, aligning with government initiatives and fostering a deeper connection with the Indian market.”

Now, with Tata Electronics Private Limited having acquired the Wistron plant in Bengaluru where iPhones are produced, the Silicon Valley giant is strengthening its roots in India. The Tata group company will be the first Indian maker of iPhones. Taiwan’s Foxconn and Pegatron are two other companies that make iPhones in India.

Despite the traditional price sensitivity of the Indian market and the novice nature of the country’s manufacturing capabilities, Apple now sees a lot of big opportunities in India. From consumption to production, India can potentially be a key partner for the tech giant. This has been possible because Apple was successful in its comprehension of India’s aspirations. As the country’s economy grows further and the aspirations of its citizens rise higher, Apple stands to gain much more.